Alligator Indicator

The Alligator is an indicator suitable for large time frames with very high reliability and only suitable for trending markets. It doesn’t work well with sideways markets because false signals occur

This article is part of a series that presents the use of various indicators available in MT4, MT5, or TradingView. The purpose is to help traders learn how to use and choose indicators that suit their trading habits and styles to generate profits. In this article, we present an indicator called Alligator. Let’s see what details it has – we’ll explain it all in this article.

The Origin of the Alligator

The Alligator is an indicator created around 1996 by technical analyst Bill Williams. It’s an indicator that shows the trend of prices, and its appearance and function are similar to Exponential Moving Average (EMA) or Simple Moving Average (SMA)

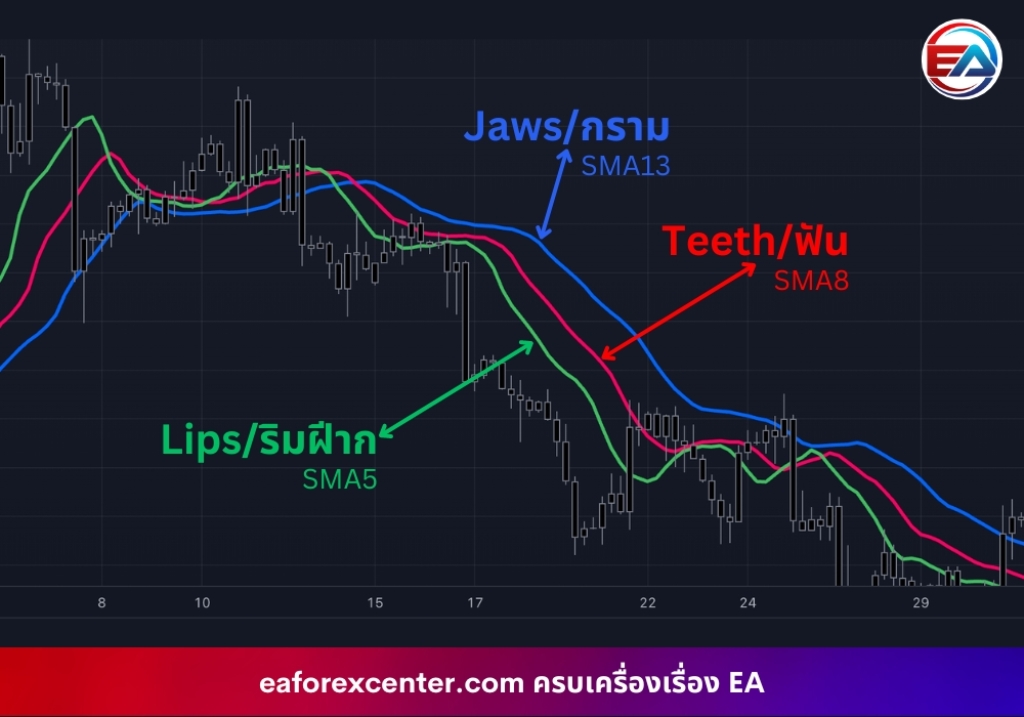

As for why it’s called Alligator or “crocodile”, it’s because the Alligator consists of 3 lines – upper, middle, and lower. The upper line represents the jaw (Jaws), the middle line represents the teeth (Teeth), and the lower line represents the lips (Lips) of an alligator

The movement of this alligator indicates the trend in the market, accounting for 15%-30%, while the other 70%-85% is sideways market. The period when we can make the best profits is during trending markets. Therefore, if we know how to use the Alligator, it will help increase our profit opportunities

Calculation and Reading Alligator Values

As mentioned above, the Alligator consists of 3 lines, and all 3 lines are Simple Moving Average (SMA) lines with different settings as follows:

- Jaws (blue line) is the average of SMA13* with **Offset smooth setting at 8

- Teeth (red line) is the average of SMA8 with Offset smooth setting at 5

- Lips (green line) is the average of SMA5 with Offset smooth setting at 3

If you observe carefully, the numbers 13, 8, 5, 3 are Fibonacci sequence numbers. These different settings make each line move differently. The Lips line (green) has the most volatility because it has the smallest number of bars for averaging, followed by the Teeth line (red) and Jaws line (blue) respectively

The movement pattern of the Alligator in an uptrend: all 3 average lines will separate with the Jaws line at the bottom, Teeth line in the middle, and Lips line on top. Imagine an alligator waking up and opening its mouth to eat. In a downtrend, the line positions are reversed: Jaws line on top, Teeth line in the middle, and Lips line at the bottom. We can profit from both Buy and Sell positions during these trending periods

We close profits when the alligator sleeps, or when all 3 lines converge and overlap, entering a sideways period. This period should be avoided because the longer the alligator sleeps, the hungrier it gets when it wakes up. This means the longer the sideways period, the more volatile the next movement tends to be

Finding Entry Signals

Finding entry signals for the Alligator is not difficult. Here’s how:

- Look for periods or points where all 3 Alligator lines intersect or come very close together

- If the trend is upward, wait for all 3 lines to align as follows: blue at bottom, red in middle, and green on top, moving parallel in the same direction. You can enter a Buy position

- If the trend is downward, wait for all 3 lines to align as follows: blue on top, red in middle, and green at bottom, moving parallel in the same direction. You can enter a Sell position

- For aggressive entry, you can enter when all three lines completely intersect and move slightly in the same direction, without waiting for the lines to separate much

Precautions When Entering Orders

Although entry signals may seem simple, beware of false signals (Fake/False Signal). These mostly occur when the green line crosses the red line, appearing to reverse, but then bounces back without crossing the blue line. This is quite dangerous for impatient traders who want to enter aggressively

Additionally, we must recognize whether the market is in a sideways period at that time. There are many instances where entry signals appear complete, but the market chooses to go sideways. We can handle this by using knowledge of support-resistance or Demand-Supply to help set Stop Loss

Take Profit Points

Once you know the entry point, when should you take profit? The answer lies in entry signal rule #1: when all 3 lines intersect and change trend. Imagine an alligator opening its mouth to eat, whether uptrend or downtrend. When the alligator closes its mouth, it means it’s full – that’s when we should close and take profit

Or if a trader has a different trading strategy, such as closing profit at 500 points or with any other conditions, they can close and take profit without waiting for the 3-line intersection signal

Summary

The Alligator is an indicator suitable for large time frames with very high reliability and only suitable for trending markets. It doesn’t work well with sideways markets because false signals occur with many fluctuations of lines intersecting back and forth multiple times

Therefore, you should study its usage, conduct back tests every time, and importantly, don’t forget to set Stop Loss. If you’re interested in EA that applies the Alligator, you can buy it here (Click to buy product)

อ้างอิง

- https://www.ig.com/en/trading-strategies/what-is-the-alligator

- https://www.forextraders.com/forex-education/forex-indicators/alligator-strategy/

- https://forexthai.in.th/alligator/

- https://thaibrokerforex.com/

- https://www.chiangmaifx.com/indicator/141-alligator

- https://fbs.co.th/analytics/guidebooks/alligator-255

Reviews

There are no reviews yet.