What is Anpan EA

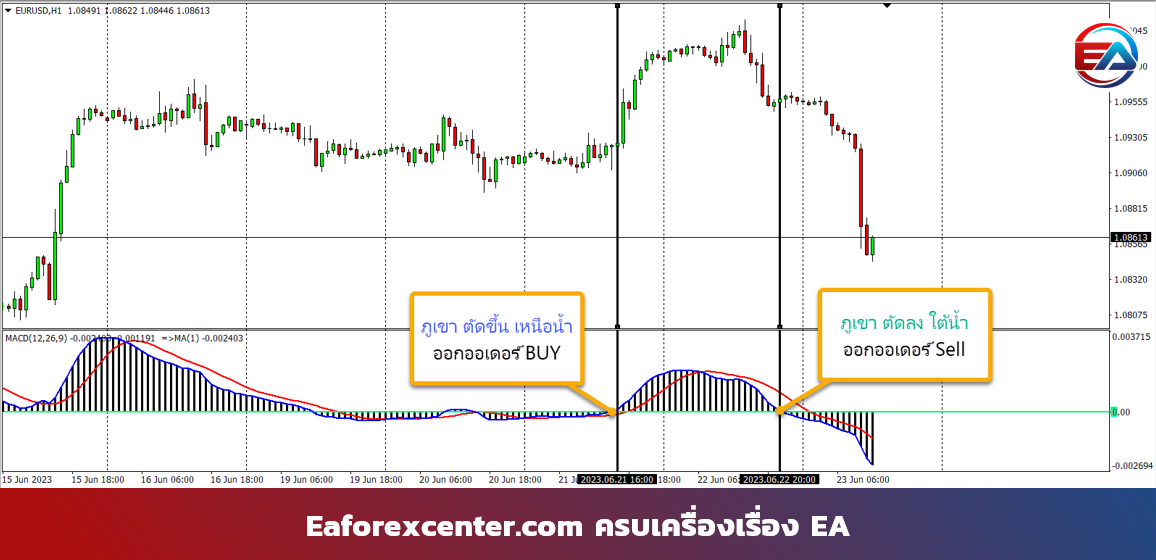

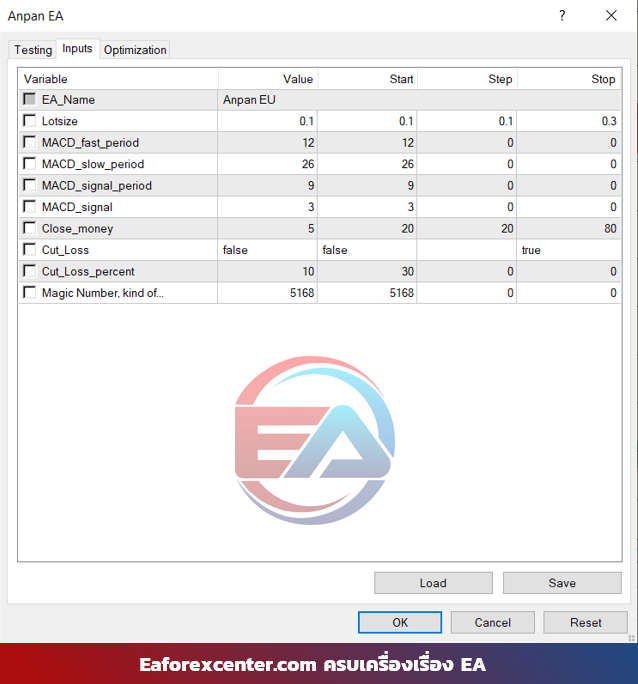

Anpan EA is an automated trading system developed from MACD indicators principles. The buy order entry method occurs when the Signal line crosses the Main line 3 times, and similarly for Sell orders.

Backtest System Setup

|

Backtest System Setup Table |

|||

| Topic | Details | Topic | Details |

| Data | Tick data (99.90%) | Leverage | 1:500 |

| Spread | Variable | Optimize Slippage | Use |

| Delay of market | 30-40 ms | Delay of Pending | 30-40 ms |

| Maximum backtest period is 3 years Backtest ผ่าน คือ 3 ปี | |||

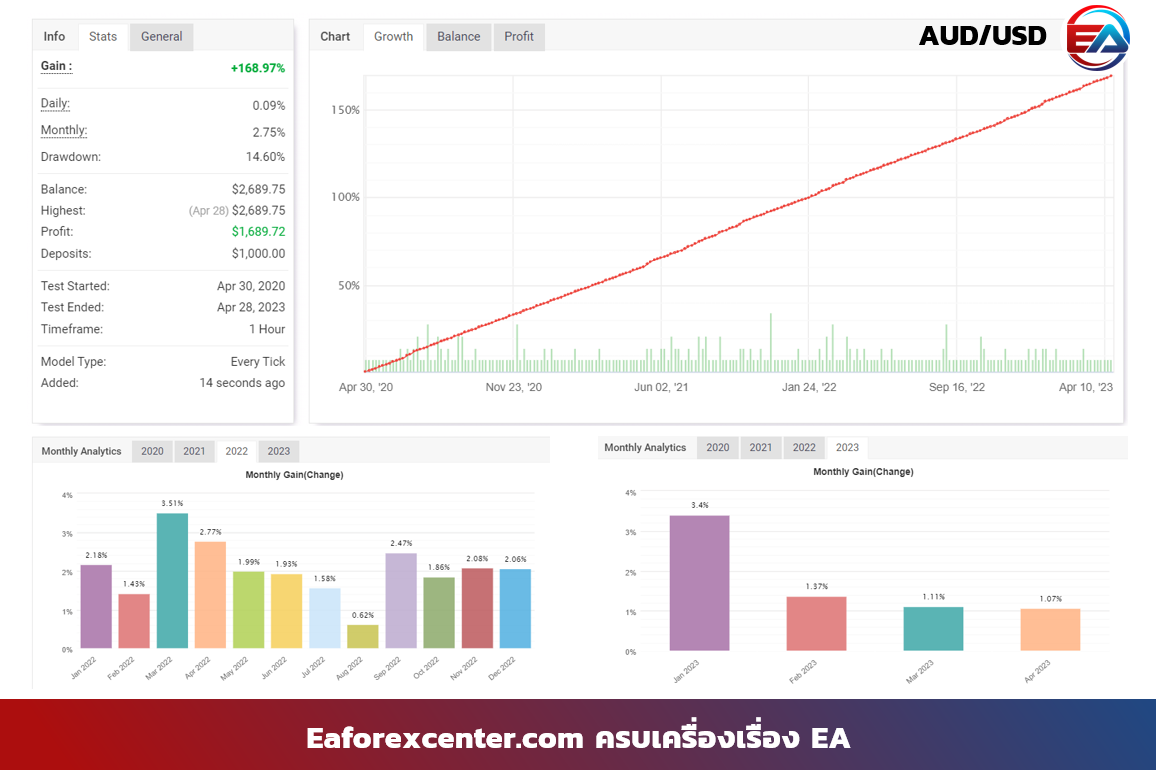

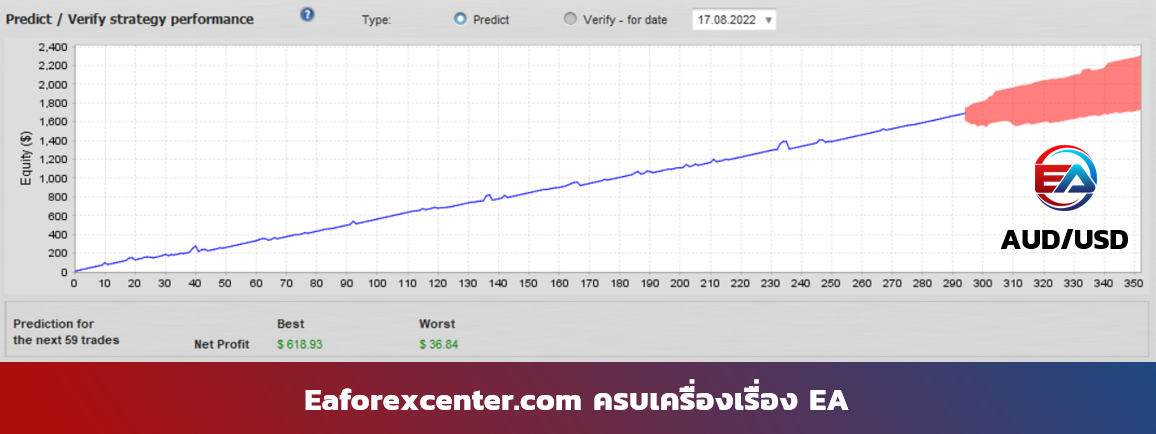

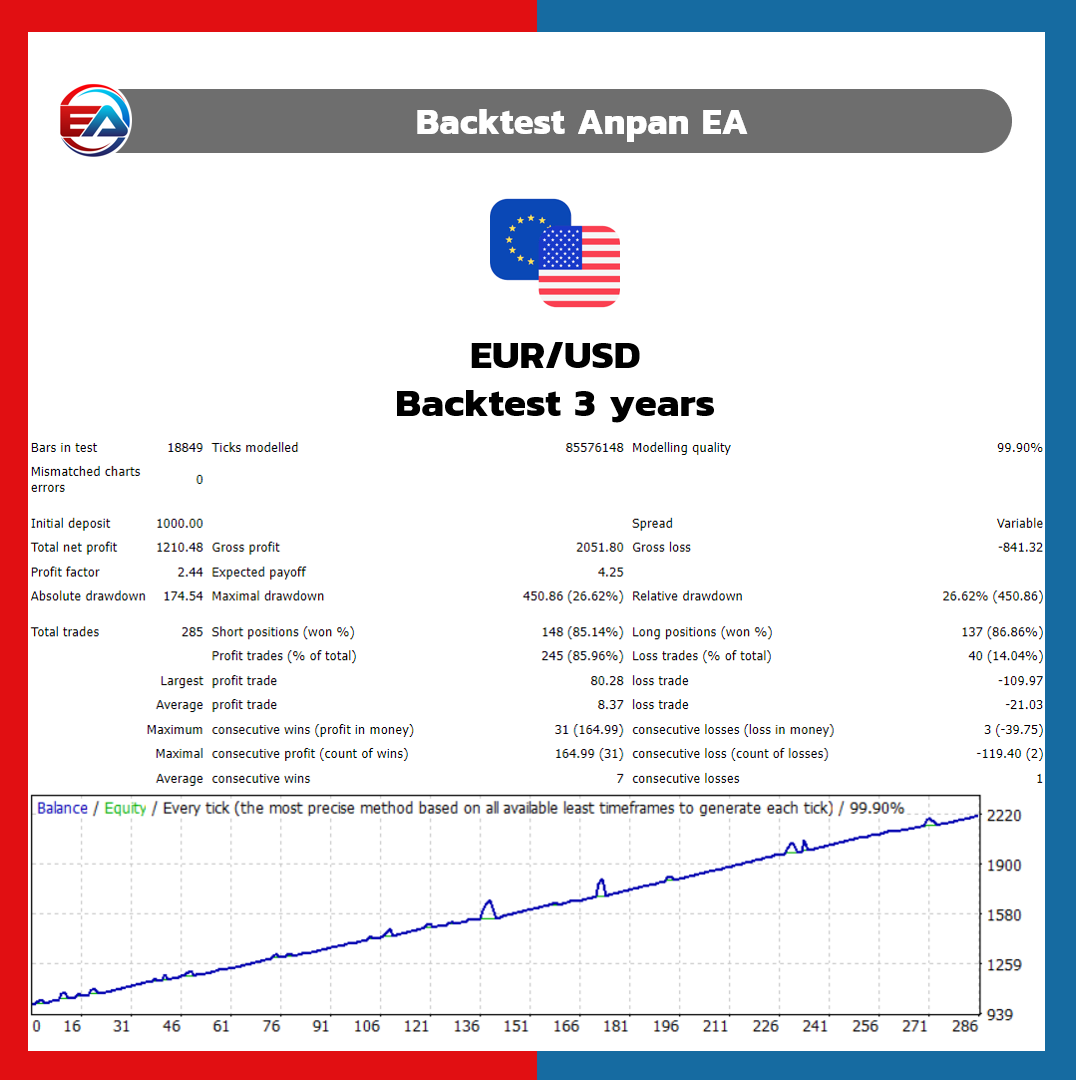

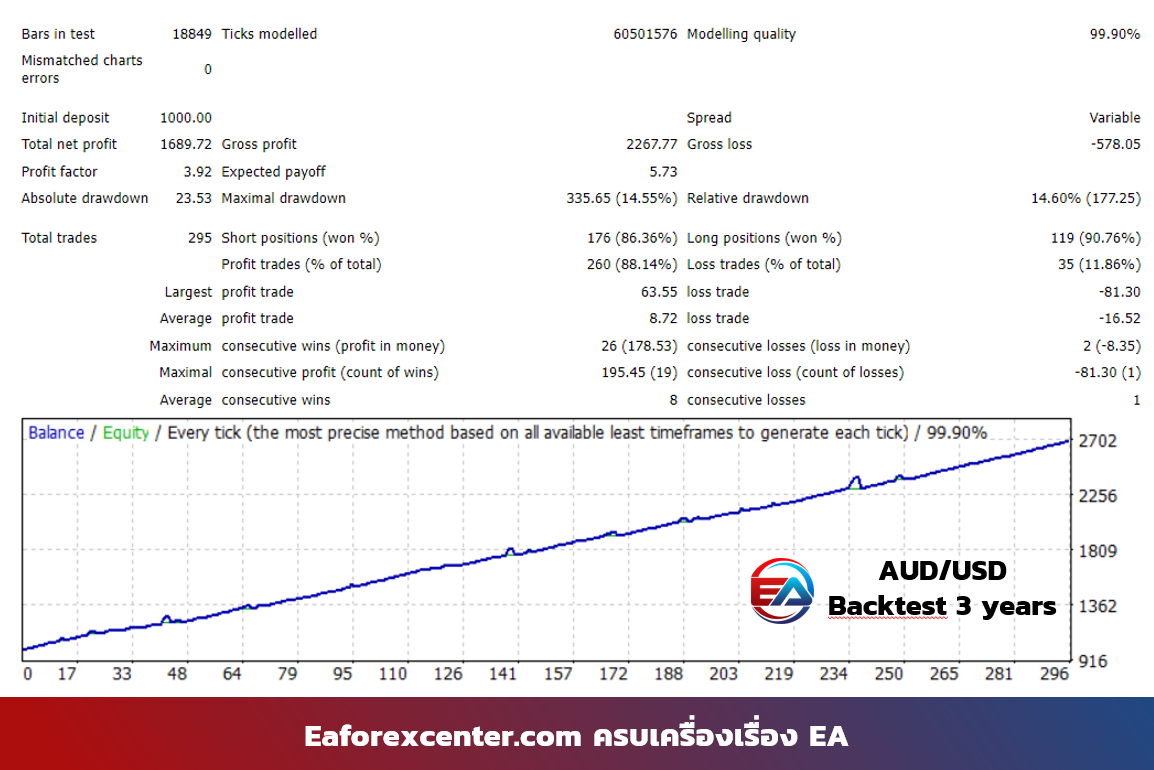

After importing the 3-year backtest results (AUDUSD pair) from MT4 to myfxbook for analysis, we found that Anpan EA achieved 168% profit with only 14.40% drawdown, averaging about 2.75% profit per month.

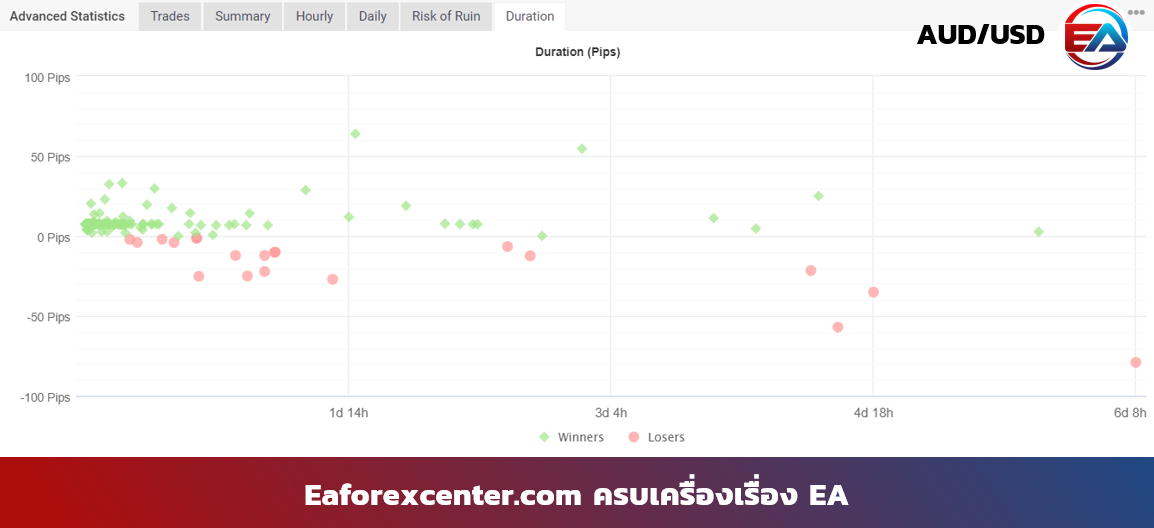

Looking at Duration (pips), we found that Anpan EA’s longest holding period was 6 days, but most trades close within 1.5 days. Traders can consider using cut loss if EA holds longer than 4 days or use the built-in Cut Loss system.

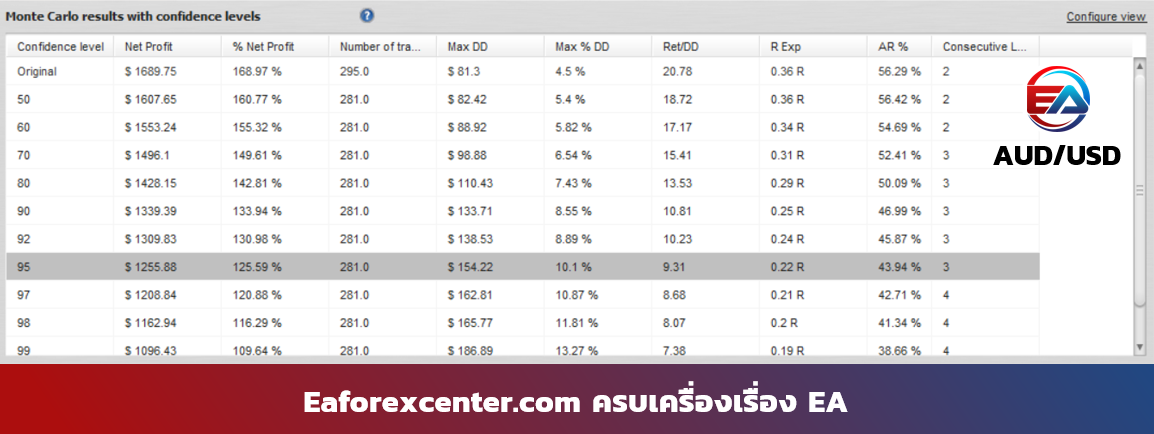

Testing real-world probability scenarios is essential before using an EA. The test shows that at 95% CI, Anpan EA has Net Profit of 125.59% with MAX DD of only 10.1% and Ret/DD of 9.31, which is relatively modest.

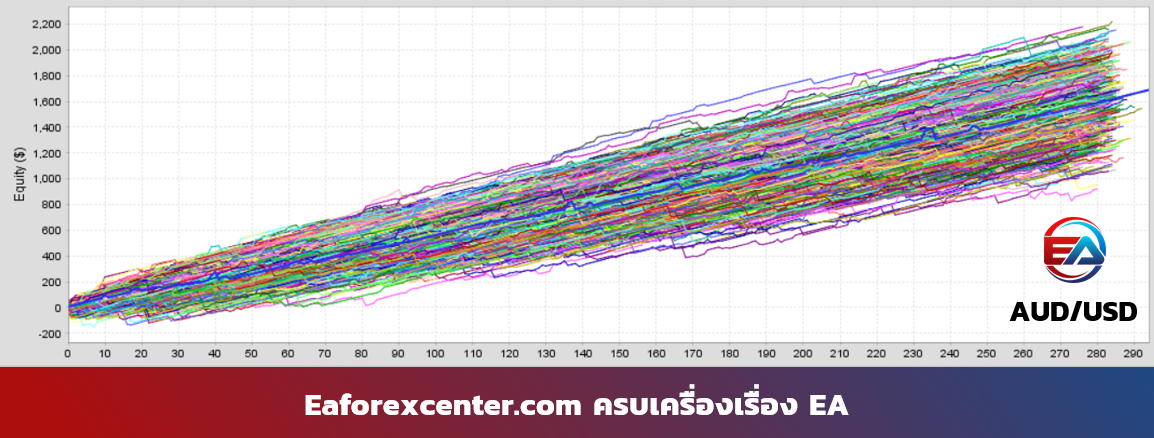

Additionally, the Equity vs Orders graph shows potential scenarios if the forex market changes in 1,000 different ways. None of the simulations showed negative results during the 3-year test period.

When predicting future performance after running the backtest, we found that the probability remains positive (pink band in Figure 8), and even in worst-case scenarios, it still generates profit.

- MACD modification and setting

- Cut loss function (on-off)

- Close trade by sum money

- Winrate 80% +

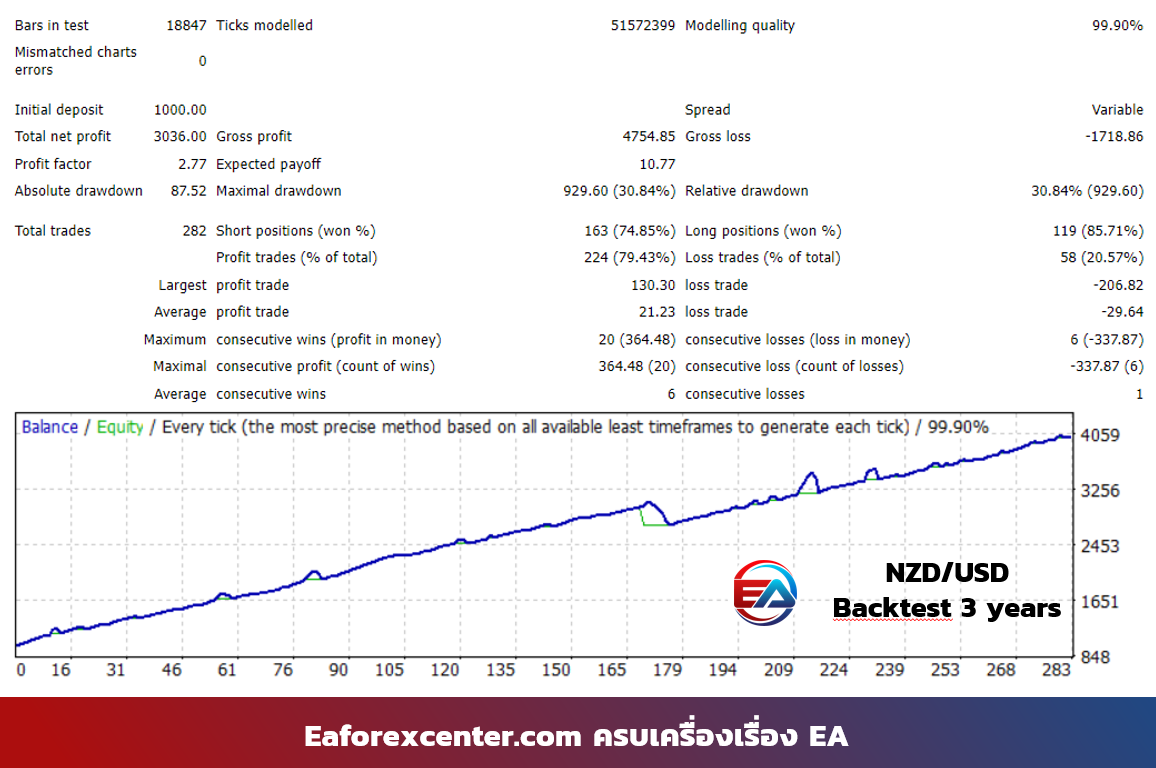

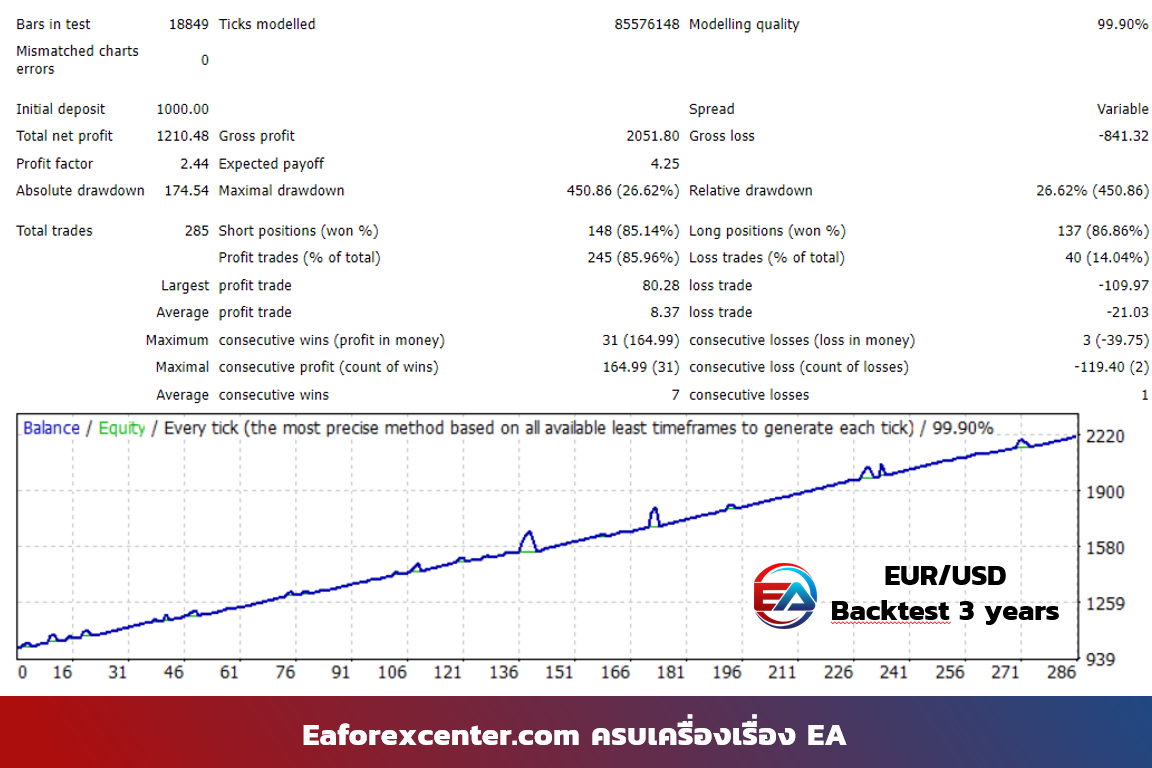

- Currency Pair: NZD/USD, AUD/USD, EUR/USD

- Time frame: H1

- Ping: 6-60 ms

- VPS: mt4could (recommended)

| Capital | Account Type | Initial Lot size |

| $100 | Cent | 0.1 |

| $1,000 | Cent | 1.0 |

| $1,000 | STD, ECN | 0.10 |

| $10,000 | STD, ECN | 1.0 |

Investment carries risks, and backtesting only uses models and parameters to explain data sets (99.9% tick data). It cannot predict the future with 100% accuracy but shows trends indicating potential market success.

Traders or investors should study how the EA Forex works before deciding to use it and importantly should only invest cold money (money that won’t impact their life if lost).

Moving Average Convergence Divergence (MACD) can generally be pronounced as “Mac-D” or “M-A-C-D”. This indicator was conceptualized and developed from Moving Average by Gerald Appeal in the 1970s by using two Exponential Moving Averages (EMA) of 26 and 12 days to find their difference or distance, which is then displayed as the MACD line.

After getting the MACD line, there’s also a Signal Line and Histogram, which I’ll explain in detail in the next section. Since MACD is classified as an Oscillators indicator, it’s suitable for both trend analysis and momentum viewing.

How MACD Indicator Works

Calculation Formula and Meaning

As I mentioned, MACD indicator consists of three main components: MACD line, Signal-Line, and Histogram, which are based on MA or Moving Average with different formulas as follows:

- MACD line formula: MACD = EMA(12) – EMA(26)

- Signal Line formula: Signal Line = EMA(9) of MACD

- MACD Histogram = MACD – Signal Line, which equals the distance between MACD and Signal Line

How to Use MACD Indicator

First, we need to call the MACD indicator by logging into MT4 and selecting as shown in the image below:

Then set the MACD parameters. I’ll use the original values set by the developer as shown below, though traders can modify these according to their techniques:

Next, I’ll set the colors by clicking the Colors tab. This depends on user preference. I’ll set thicker lines for better visibility. Main color is for the Histogram, while Signal is for the Signal Line color.

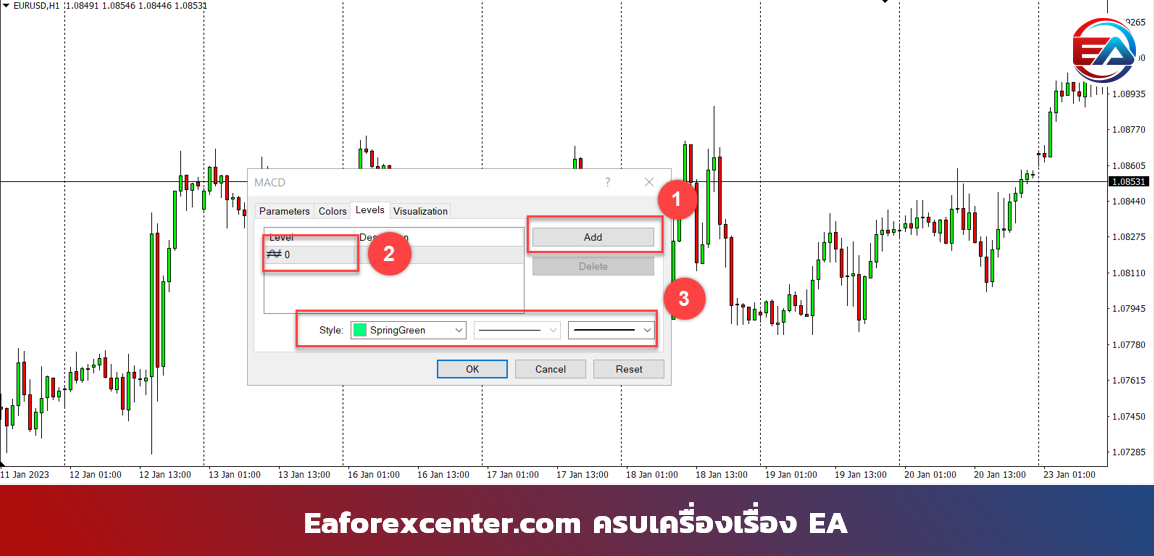

After setting colors, I’ll set the level lines to make the zero level more visible. Most people call this the water level. I’ll explain how to use it in later steps. I’ll choose a thick green line as shown below, then click “OK” to finish.

After setting up the MACD indicator, we can easily add MA lines. This is optional, but I’ll share a small technique for further development. Go to Navigator and drag MA onto the MACD window as shown below:

Next comes an important trick. I’ll set it as a thick blue line, change Period to 1, and select parameters as shown below. After clicking “OK”, this adds a line representing the mountain edge. Traders can adapt by adding different EMA or SMA values according to their techniques.

After calling EMA and MACD indicators, it will look like this with various components:

For basic usage, there are multiple methods. I’ll present two: price trend analysis and Divergence detection. First, let’s look at price trend analysis. Simply put, when the mountain crosses above water, it indicates an uptrend, and conversely, when it crosses below water, it indicates a downtrend.

The second method is Divergence detection. Draw trend lines on both the candlestick chart and MACD simultaneously. When the trend lines show opposite directions, it indicates Divergence, allowing for order entry/exit as shown below:

However, MACD indicator signals are based on historical closing prices and only serve to time trades and show price trend direction changes. Therefore, it should be used alongside other indicators like EMA and RSI.

“If you want to wage war, you must first know the enemy’s inner workings to achieve victory easily”

– Li Tian’s words warning Zhou Yin against attacking Liu Bei –

Reviews

There are no reviews yet.