Blue Beetle EA

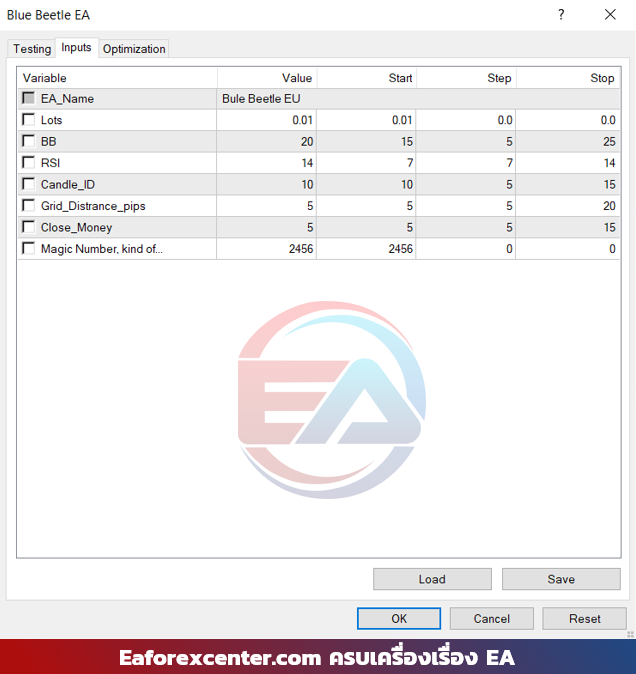

Blue Beetle EA is an automated trading system that relies on order entry principles using Bollinger bands indicator and RSI indicator, which can generate profits in the Forex market. Although it may not create huge profits, it has low risk.

Backtest System Setup

|

Backtest System Setup Table |

|||

| Topic | Details | Topic | Details |

| Data | Tick data (99.90%) | Leverage | 1:500 |

| Spread | Variable | Optimize Slippage | Use |

| Delay of market | 30-40 ms | Delay of Pending | 30-40 ms |

| Maximum period that can be backtested is 3 years | |||

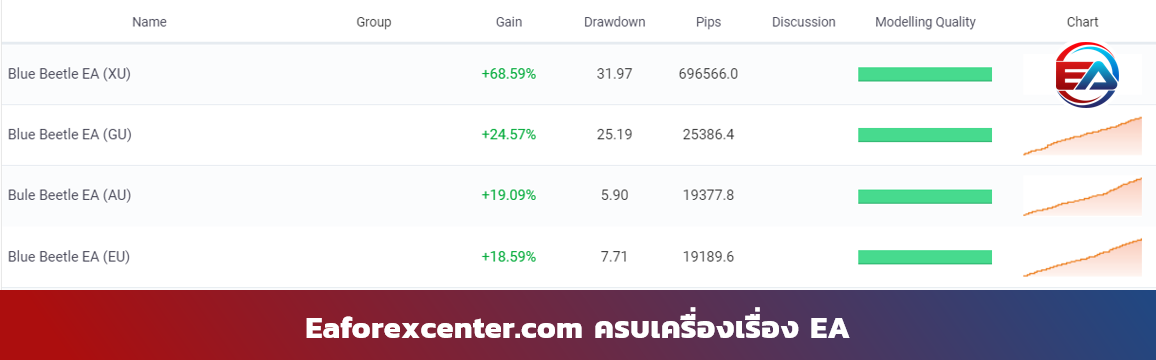

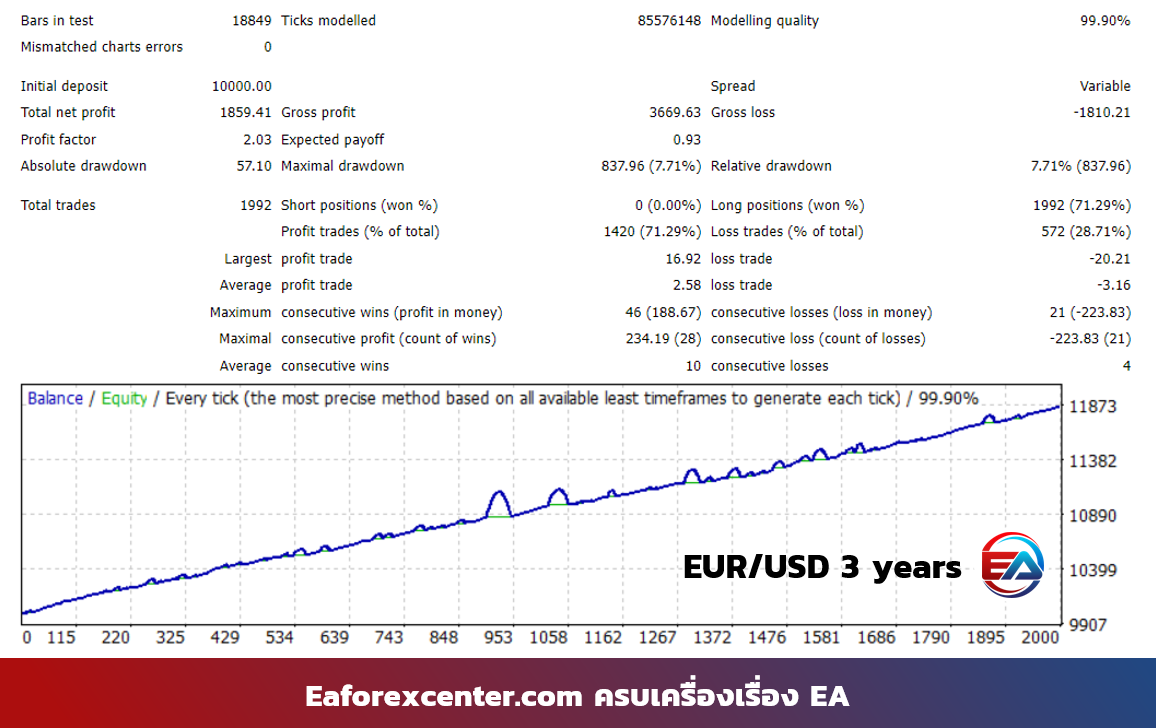

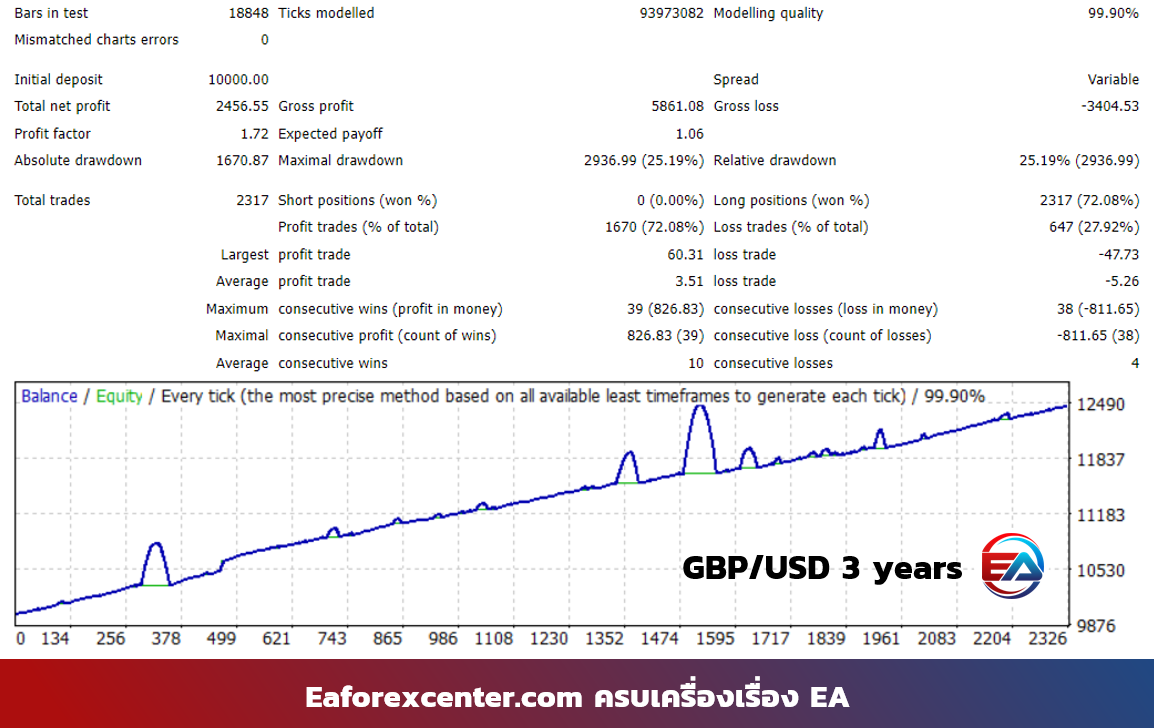

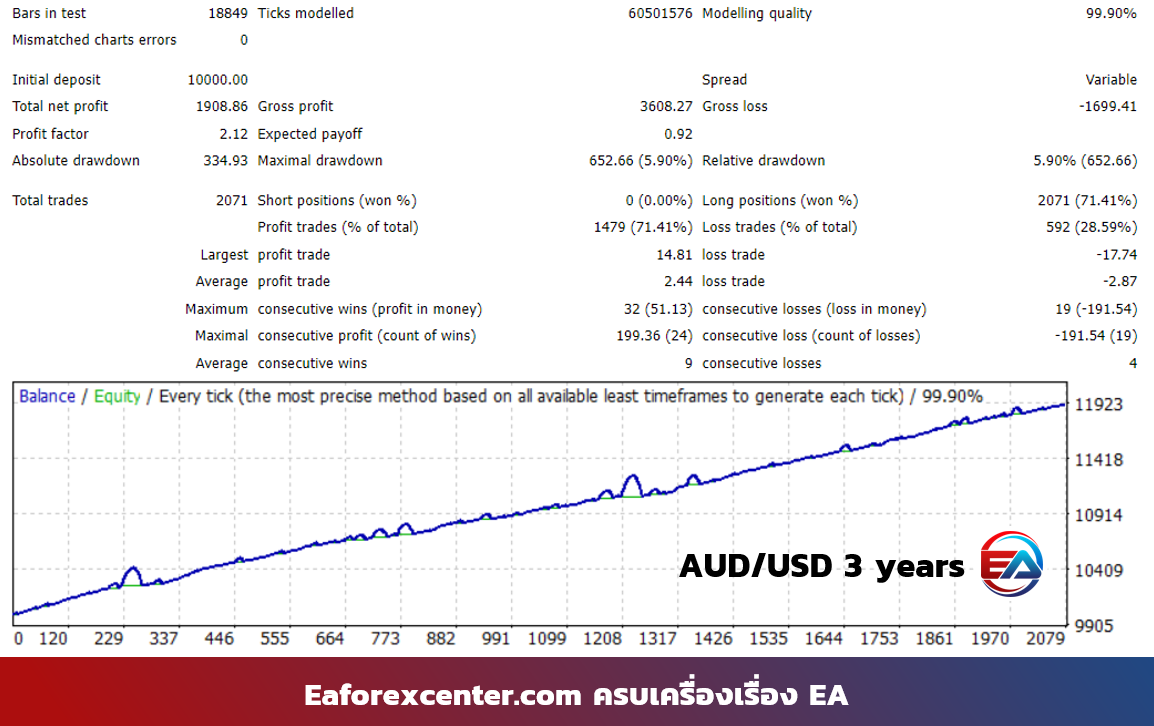

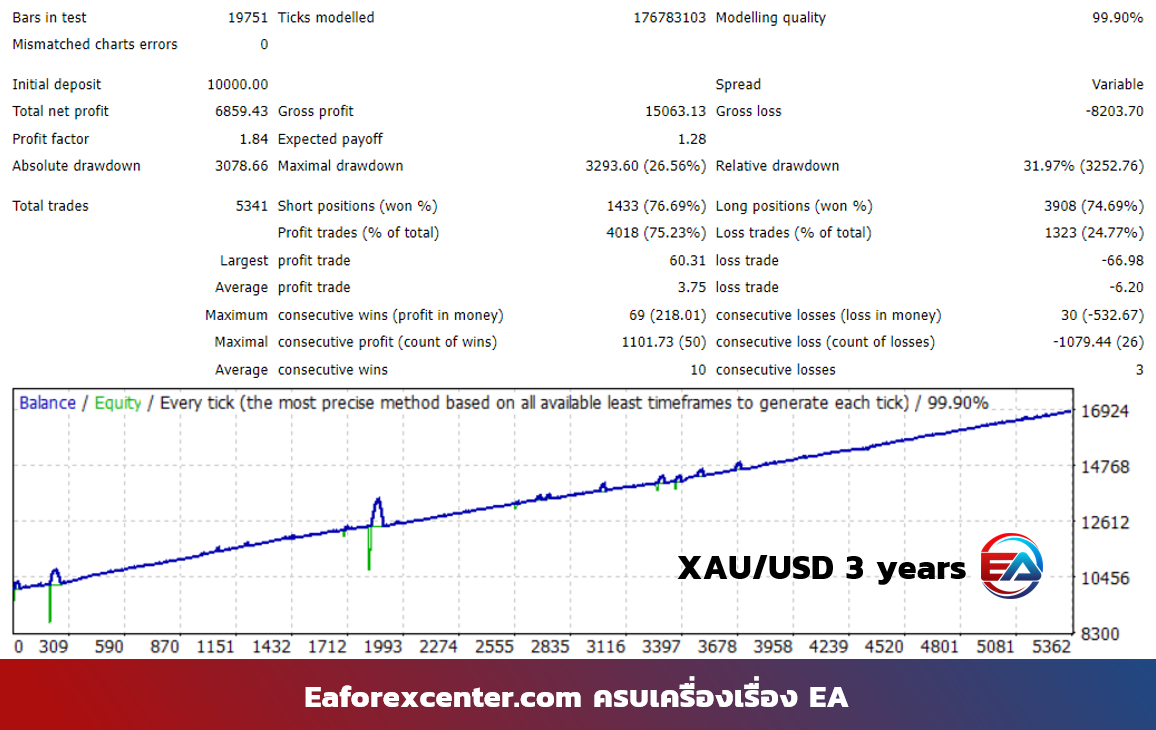

After we imported the backtest results into myfxbook for trading statistics analysis, we found that drawdown values were 7.71%, 5.90%, 25.19%, and 31.97% for EURUSD, AUDUSD, GBPUSD, and XAUUSD currency pairs respectively, while profits for each currency pair were not very high

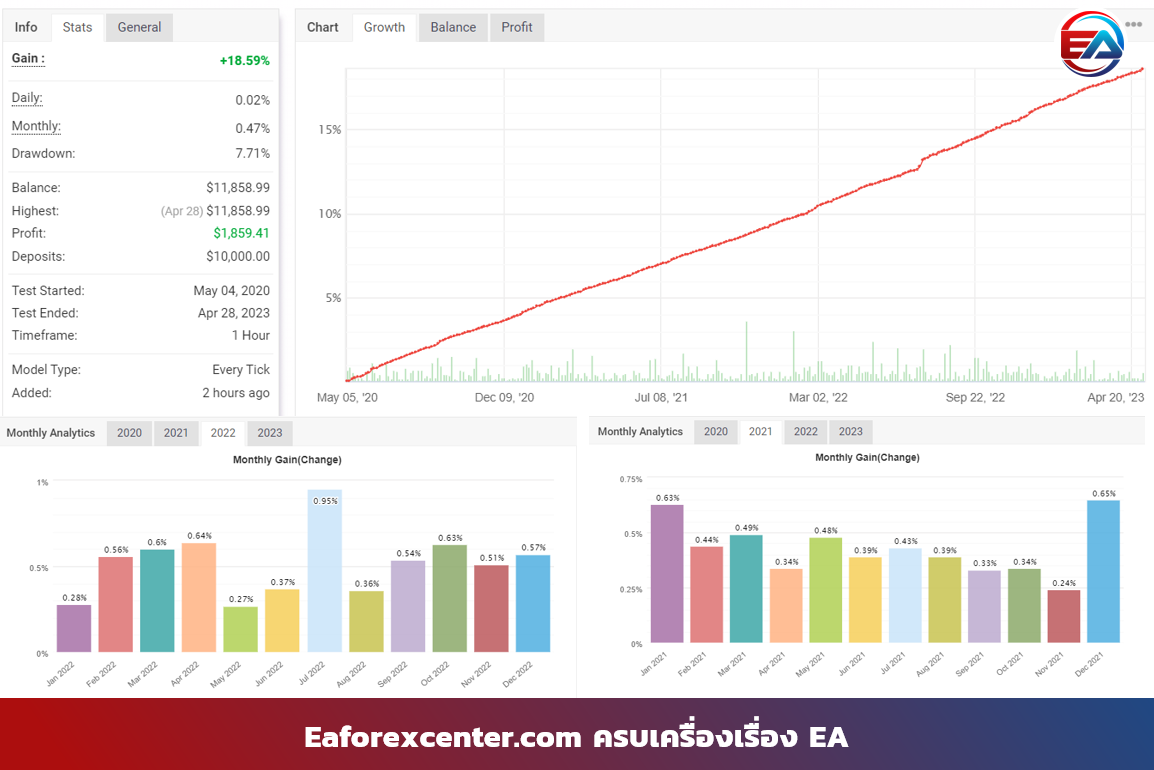

When looking at myfxbook for EUR/USD currency pair, we found that Blue Beetle generates consistent profits even though they’re not very large, which is suitable for people with heavy capital who focus on small profits but high safety

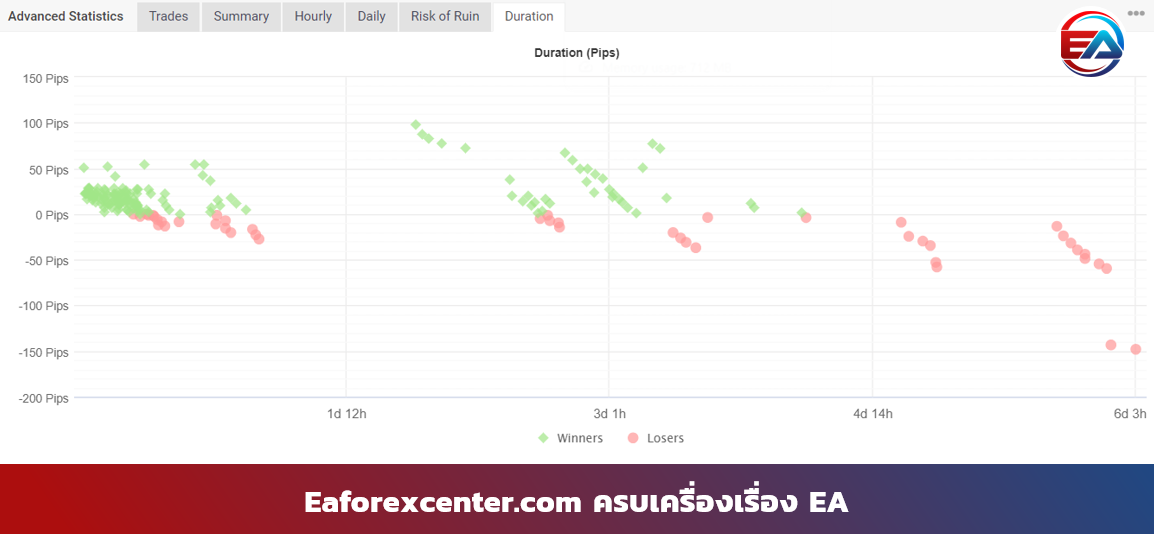

Looking further down at the Duration section, we found that Blue Beetle holds orders for a maximum of about 6 days, and we can observe that if the EA keeps positions open for more than 4 days, there’s no chance of profit. Therefore, we can cut losses ourselves if we assess the situation and determine there’s unlikely to be a reversal

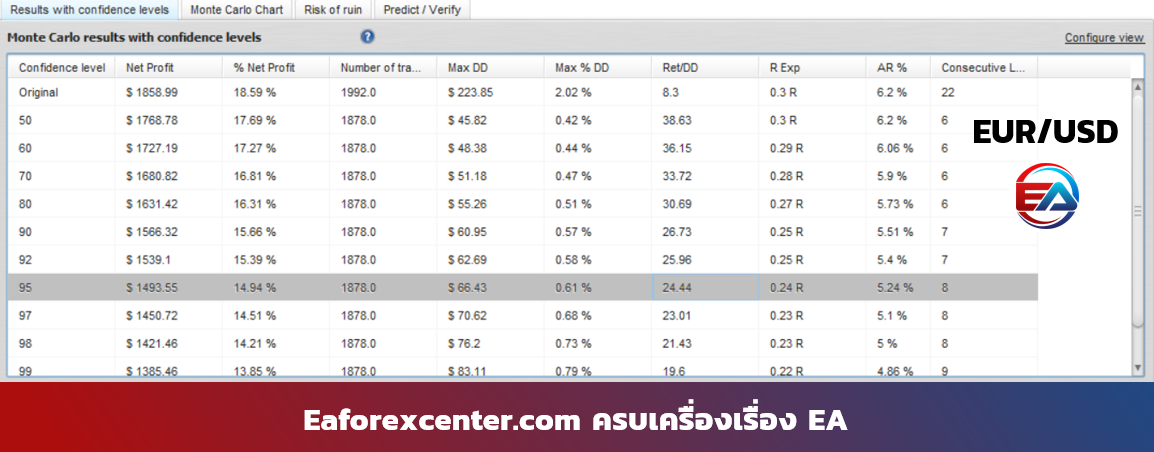

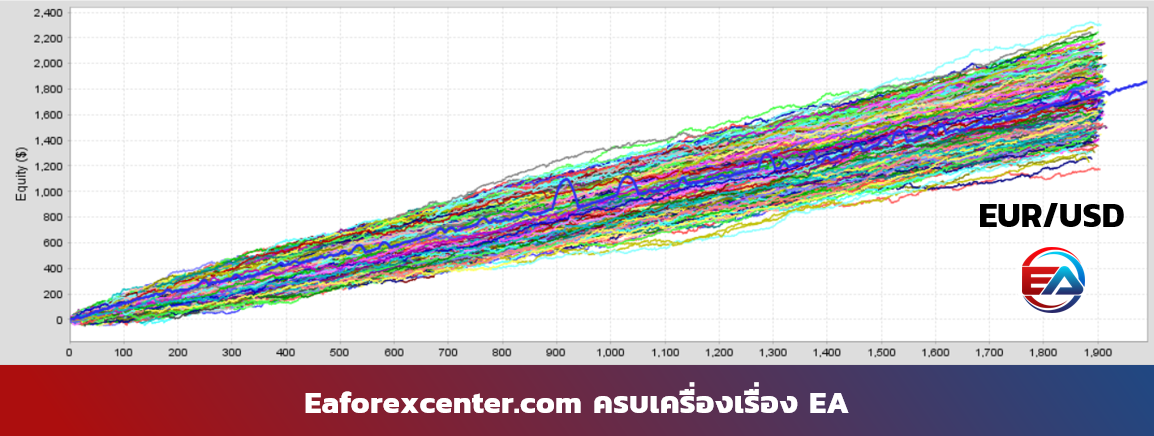

From Monte Carlo Simulation testing of Blue Beetle on EURUSD currency pair, we found that at 95%CI point, there’s still profit from running the EA at 14.94% while MAX%DD is 0.61% and Ret/DD is 24.44, which is considered quite good

When we look at the Equity% vs Ordered graph, we found that the Obverse value is in the middle range and the graph shows symmetrical patterns, which indicates that during the 3 years of testing, the EA has reasonable stability

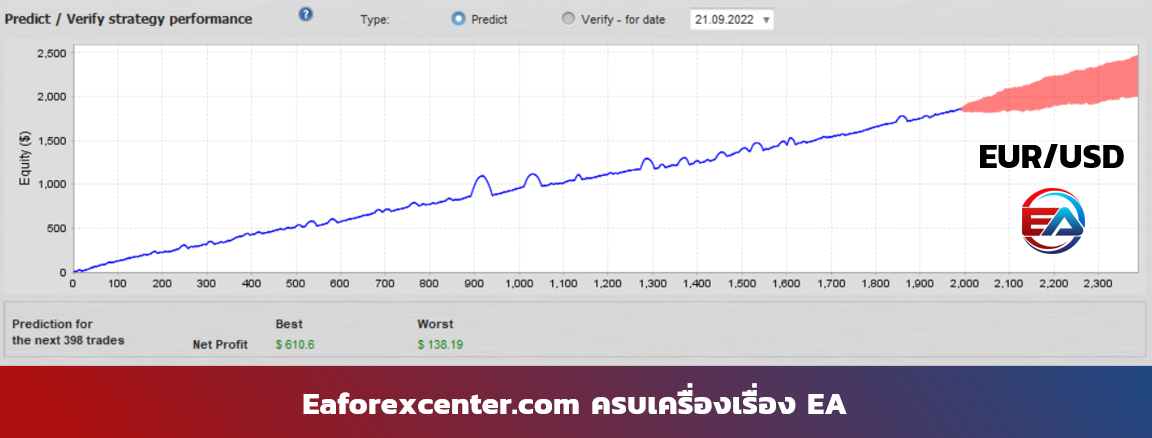

When looking at the future prediction section after 3 years of backtesting, we found that in the worst-case scenario, the EA still generates small profits, which might still be considered not worthwhile if continued. You might consider running more than 1 currency pair but not more than 3 currency pairs if capital equals 10,000 USD

- Bollinger bands Divergence

- RSI Divergence

- Take profit and Stop loss setting

- Normal Grid System

- Currency Pair : EUR/USD (recommended), XAU/USD, AUD/USD, GBP/USD

- Time frame : H1

- Minimum capital : 10,000 USD

- Ping: 6-60 ms

- VPS : mt4could (recommended)

Since this EA is a Grid system, we see somewhat high DD because it drags equity into negative territory for a while before the EA makes corrective moves to return to positive territory. If the EA holds positions for more than 4-5 days, consider finding a good opportunity to cut losses

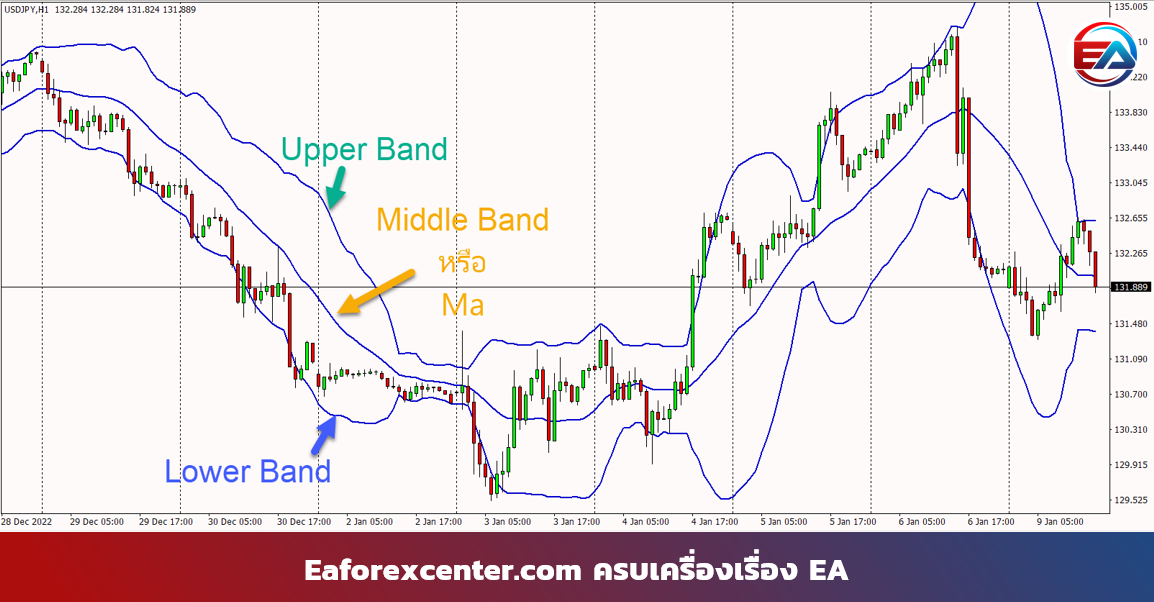

Bollinger Band is a technical analysis tool that indicates price volatility over a specific period and is very popular today. It can be used in stock markets, oil, crypto, and Forex markets as well

Bollinger Bands is an indicator that moves according to trends and momentum occurring within the market, invented in the 1980s by John Bollinger, an experienced analyst

Bollinger Band is a tool used to analyze market volatility based on Moving Average Indicator that works with calculations using Standard Deviation (SD) to measure price volatility. It consists of three lines: Upper Band, Middle Band, and Lower Band, which can be used for buying or selling orders. It’s considered a truly effective indicator

How Bollinger bands indicator works

Calculation Formula

The working principle of Bollinger bands indicator isn’t difficult, it just looks complicated from the mathematical equations… As mentioned, Bollinger bands indicator consists of three lines: Upper Band, Middle Band, and Lower Band, using standard 20-day data with different calculation formulas as follows:

- Upper Band

- SMA + SD x 2

- Middle Band/ Basis Band

- SMA

- Lower Band

- SMA – SD x 2

Where

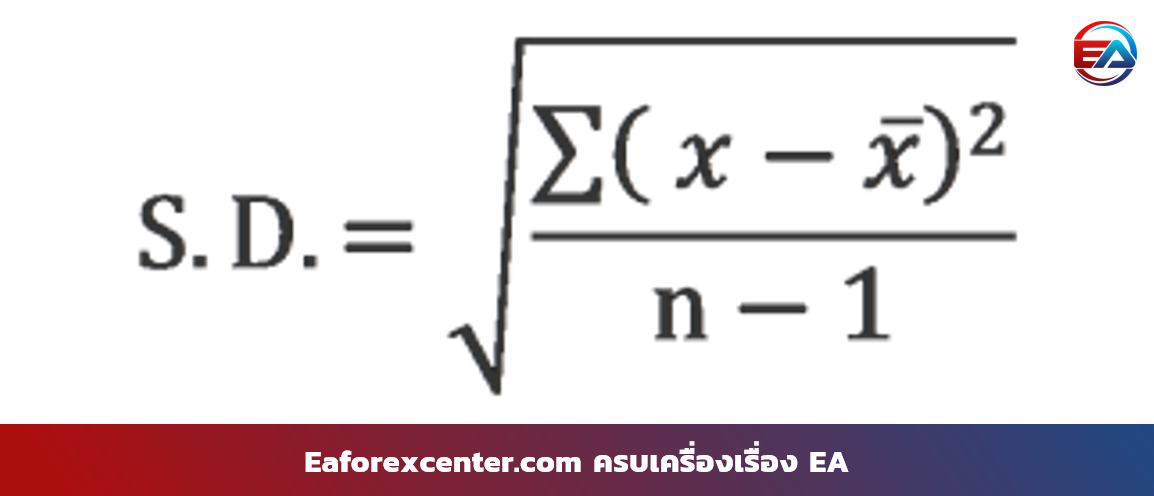

- SD is Standard Deviation: SD is the standard deviation where X = closing price of each candlestick and Xbar = average of closing prices, which is the MA line, with the following equation:

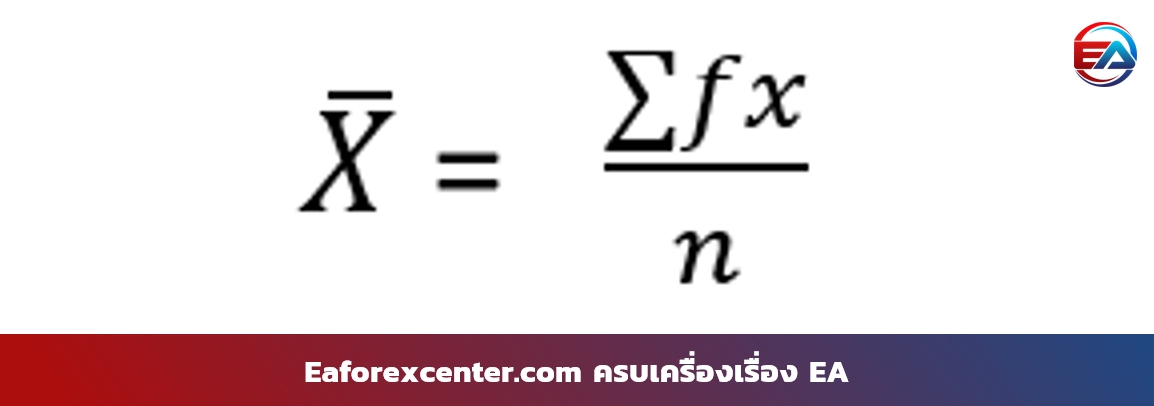

- MA or SMA is Moving Average: MA is the average of data where Xbar = average of closing prices, which is the MA line, with the following equation:

How to use Bollinger bands indicator

The working principle of Bollinger bands indicator is quite simple, generally similar to using support and resistance levels. First, let’s see how to open Bollinger bands indicator in MT4. Notice in the image below that the indicator is in the Trend category

After opening Bollinger bands indicator, you’ll see the settings window as shown below. The standard data setting is 20 days, which can be changed according to individual techniques. You can then choose line colors and thickness as desired, then click “OK”

Once settings are complete, you’ll see 3 lines appear as shown below, consisting of Upper Band, Middle Band, and Lower Band, calculated according to the formulas mentioned above

Usage is very simple. I’ll divide it into 2 easy methods. The first method is to observe the Middle Band line as shown below – when the chart breaks through the Middle Band in any direction, place an order in that direction

For example, if the chart breaks through the Middle Band upward, open a Buy position and wait for the chart to hit or break through the Upper Band, then close the order immediately. This is an easy way to make profits

At the same time, we can make profits by starting from the Upper Band or Lower Band. Look at the image below – when the chart comes down to hit or break through the Lower Band, open a Buy order because there’s a high chance the chart will reverse upward. Then wait to close the order when the chart goes up to hit the Upper Band

However, for Bollinger bands indicator to be more accurate, we should look at the overall chart picture including news beyond statistics, and should use it together with other indicators to better control accuracy, whether it’s RSI, MACD, or Alligator

Reviews

There are no reviews yet.