DCA How to Generate Monthly Income

Dollar-cost averaging or DCA is an investment method that helps reduce risk for salary earners or new investors. However, one concern with the DCA system is that if assets are in a downtrend, investors won’t be able to withdraw that money for use.

The eaforexcenter team has created an EA based on DCA principles but enhanced using the advantages of EAs that work 24 hours without emotions. This creates a system with lower loss percentages and higher profits. Additionally, investors can withdraw partial investments.

DCA is dollar-cost averaging where investors invest the same amount at set intervals, like 1,000 baht every 10th of the month. The advantage is creating investment discipline and removing emotional and timing risk factors. However, this technique, if done without proper timing, can lead to accumulated losses or inefficient returns, even if the asset has good fundamentals and a long-term upward trend.

An example of a good asset with continuous growth over decades is SCB stock, a fintech company that currently operates and holds major stakes in many companies like Siam Commercial Bank, Purple Venture, Finnix platform, MONIX, and SCB10X.

Besides good fundamentals and growth, large Thai and international funds hold this stock. With these qualities, if we DCA or buy this stock consistently for 1 year or more, the overall result should definitely be profitable. I thought so too, until… I tested by buying this stock in 2018 from January to December, 1,000 baht per month. Of course, if we saved the money ourselves, we’d have 12,000 baht by year-end. But if we used this money to buy SCB stock, you’d have

From the table, SCB stock value on December 31, 2018 was 138.5 baht, and we received a total of 85.58 shares, making our portfolio worth only 11,852 baht, a loss of 147.17 baht. The money that should have become passive income became long-term savings.

The weakness of the traditional DCA system is the inability to profit when assets trend downward, since most assets follow trends. If in a downtrend, they’ll decline for a period.

We created an EA that profits when stocks or assets trend downward, breaking through previous support and resistance levels. This strategy also allows investors to divide DCA into multiple portfolios to withdraw profitable portions for use.

- Number 1 is where we start opening buy positions. When the EA starts, it immediately buys the asset, setting a 3% profit target of the balance without stop loss. After the first take profit, it immediately buys at the next point and waits for 3% of balance before taking profit again. This continues indefinitely. For example, starting balance of $100 will take profit first at $103, then next take profit at 3% of $103, which is $106.09, and so on.

- Numbers 2 and 4 are support zones that can be adjusted. Investors predict that if price breaks through these levels, it will likely fall further. When we set numbers 2 and 4, profit points 3 and 5 are automatically created. The stop loss is the last buy entry point.

- Money management: Invest equal amounts monthly or weekly and open new portfolios each time. We tested this with a safe haven asset like gold with these results:

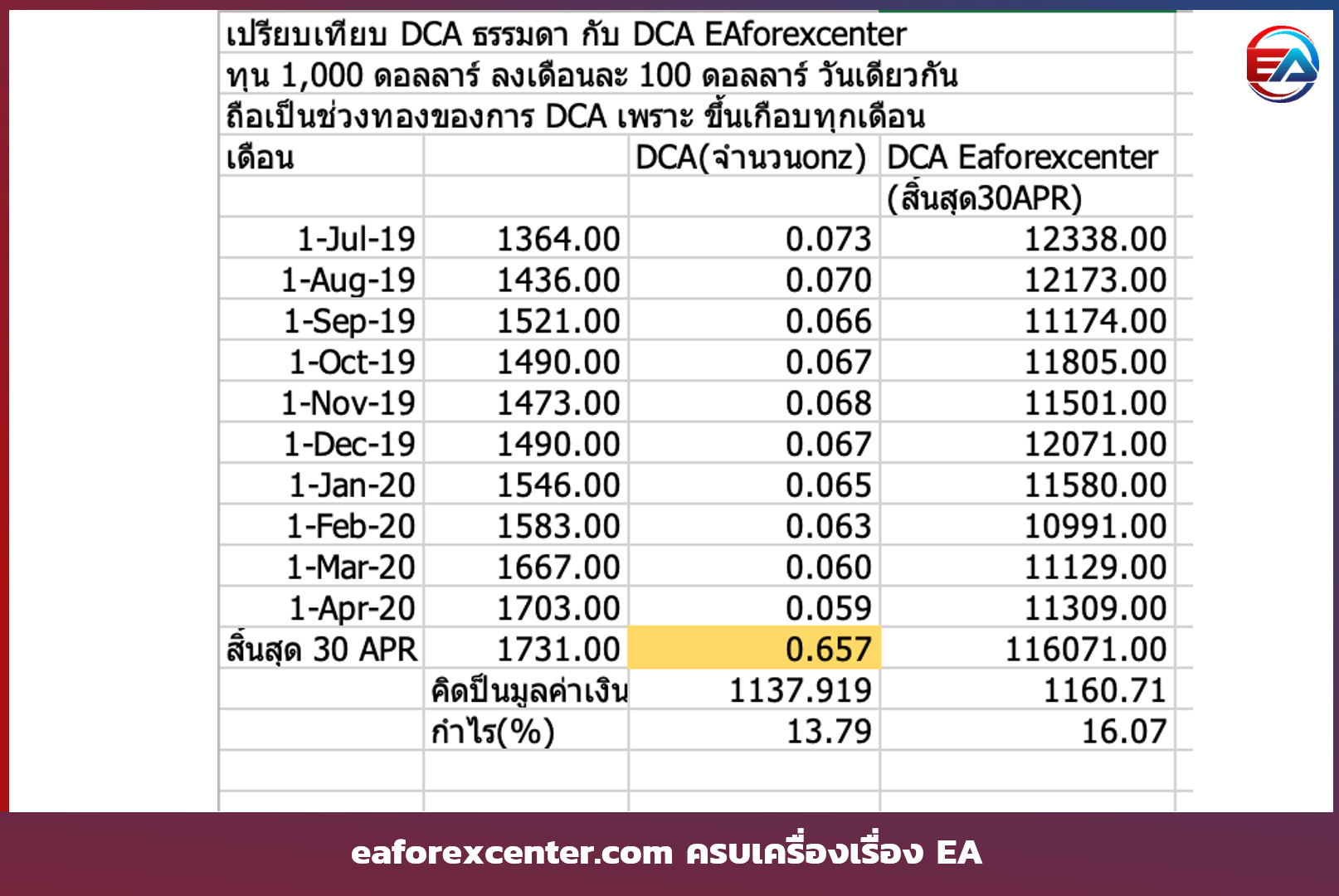

The table shows DCA from July 1, 2019 to April 30, 2019, a total of 10 months. During this period, the chart continuously rose, allowing the DCA system to profit well. Traditional DCA made 13.79% profit, but using DCA by eaforexcenter increased profit to 16.07%.

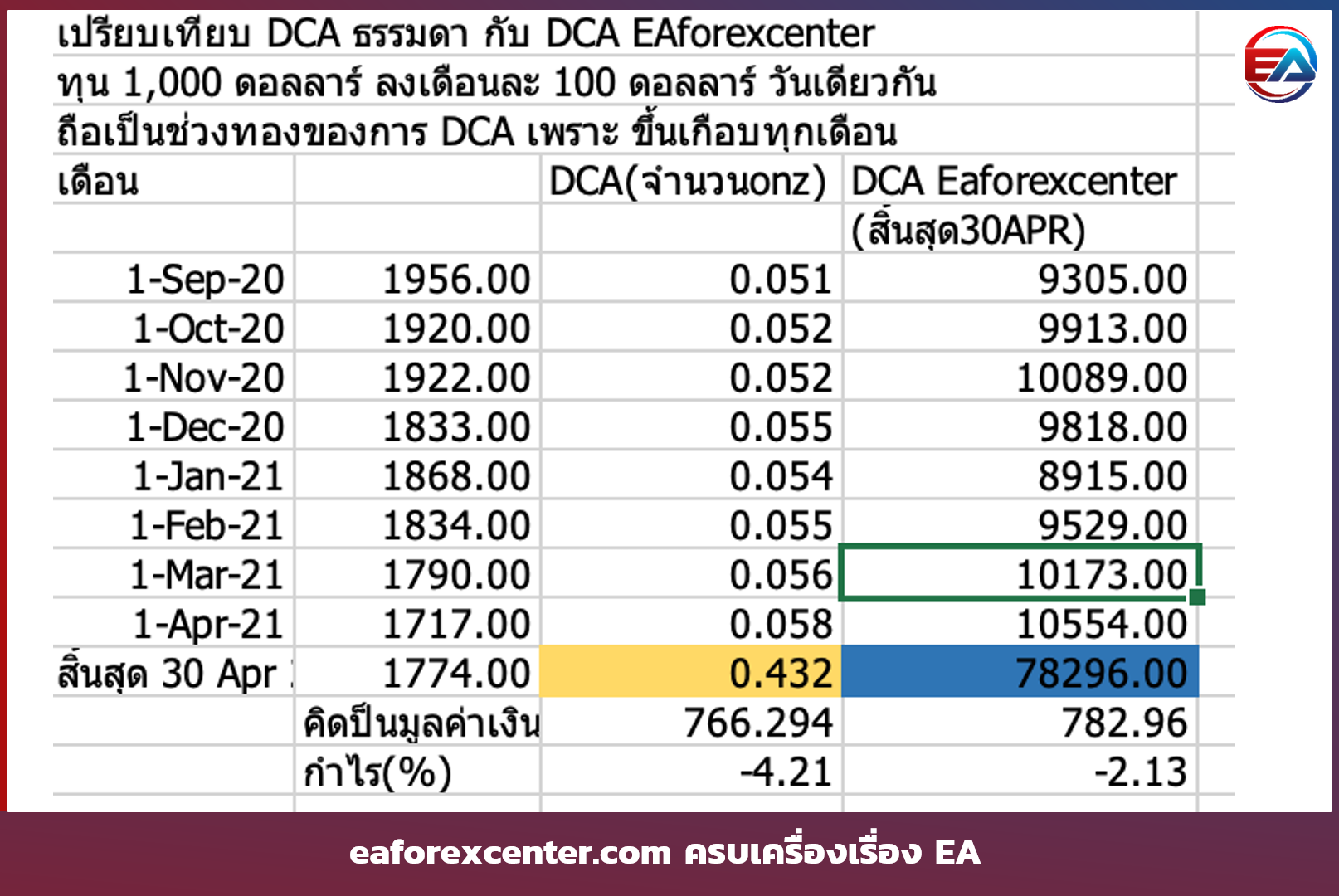

The next table shows DCA from September 1, 2020 to April 30, 2020, an 8-month period when gold was in a sideways down trend. Traditional DCA cannot profit during this time. Traditional DCA resulted in a 4.21% loss, but using DCA by eaforexcenter reduced the loss to 2.13%. This means eaforexcenter reduces DCA system losses and increases long-term profits.

Passive income is income we receive even after the work is completed, meaning it can create consistent cash flow and income. Traditional DCA investing, while a good investment method, can accumulate losses and prevent money usage during downtrends or sideways down periods, as shown in our tables. But using DCA by eaforexcenter divides our portfolio into multiple portfolios, and we can withdraw profits from profitable portfolios regularly, even if our overall portfolio is at a loss. As shown in the loss table, we found that in November, March, and April, some portions were still profitable and usable.

Using DCA by eaforexcenter is quite easy compared to other EAs since it focuses mainly on money management. Investors must divide investment money into equal monthly installments and run this EA across multiple portfolios. For example, on October 1st, run this on Portfolio A with 10,000 cents, next month on November 1st, invest in Portfolio B with 10,000 cents, and continue this pattern.

EA details are as follows:

The meaning of each number is:

- dividended means the number that divides the balance amount

- tp_percent means the percentage at which the EA starts taking profit

- zone1price means the price at resistance level 1 (nearest resistance)

- zone2price means the price at resistance level 2

- zone3price means the price at resistance level 3

- zone4price means the price at resistance level 4

- zone5price means the price at resistance level 5

- takeprofit_sell means the number of pips to close at each resistance level

Recommended pair: XAU/USD TF 1 Day

- Investors set all 8 parameters. Recommended basic values are: dividended = 100,000, tp_percent = 3, all five zone prices can be set according to support and resistance levels, takeprofit_sell = 4,000

- Install the EA and open new investment portfolios with equal amounts monthly. For example, September open Portfolio A with 10,000 cents, October open Portfolio B with 10,000 cents, and continue this pattern.

- For profitable portfolios, investors can withdraw partial funds for use.

DCA by eaforexcenter is a tool that helps make the dream of creating passive income from DCA systems a reality. Users need to understand the system’s operating methods.

Reviews

There are no reviews yet.