Ichimoku EA Forex

Ichimoku is one of the world’s most popular indicators, used by many famous coaches. For example, in Thailand, Coach Bank frequently uses this indicator for trading. We’ve adapted Ichimoku into a Grid-style EA, using a flexible Dynamic grid system for improved order execution

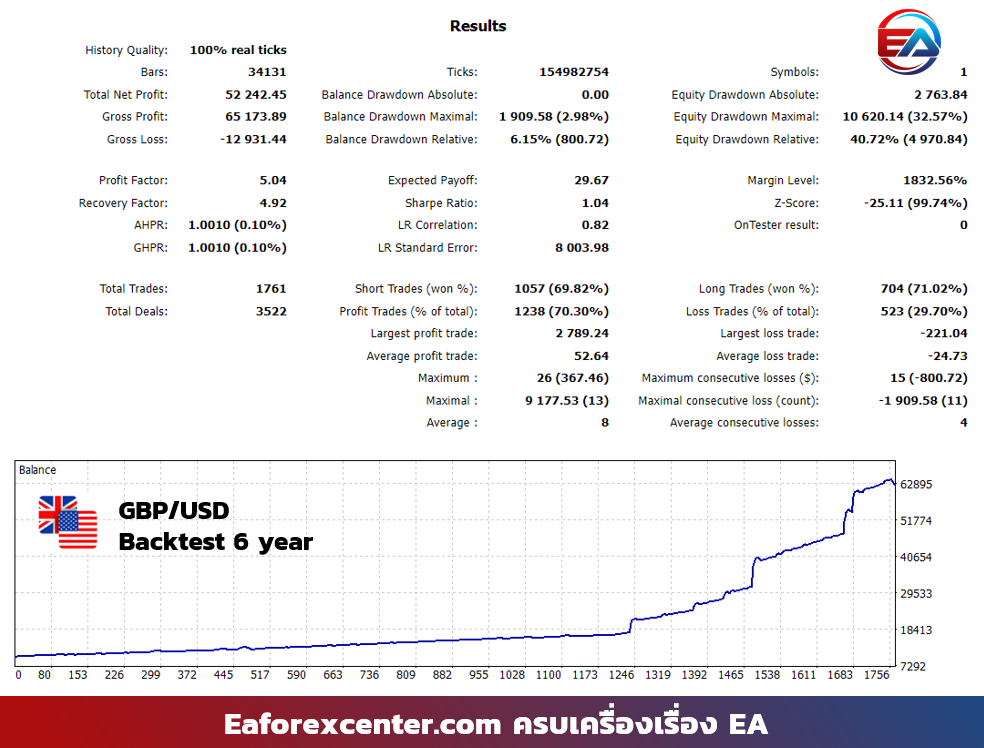

Backtest System Setup

|

Backtest System Setup Table |

|||

| Topic | Details | Topic | Details |

| Data | Tick data (99.90%) | Leverage | 1:500 |

| Spread | Variable | Optimize Slippage | Use |

| Delay of market | 30-40 ms | Delay of Pending | 30-40 ms |

| Maximum backtest period possible is 5 years | |||

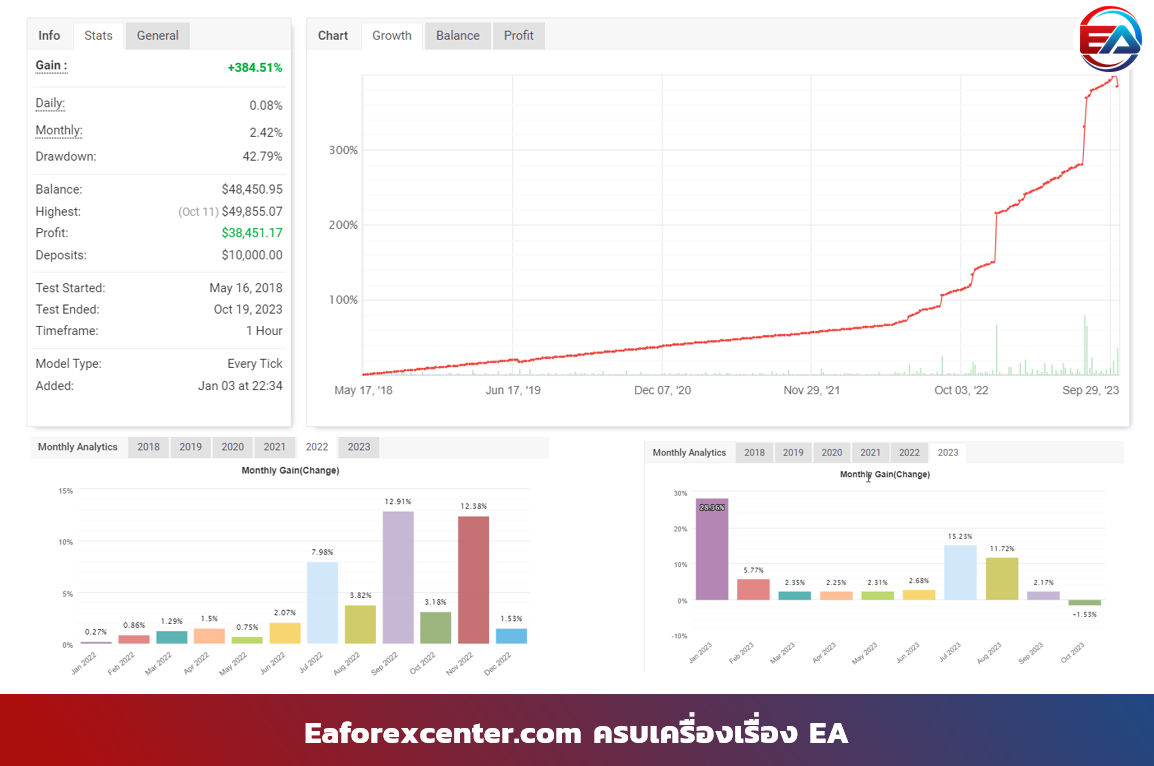

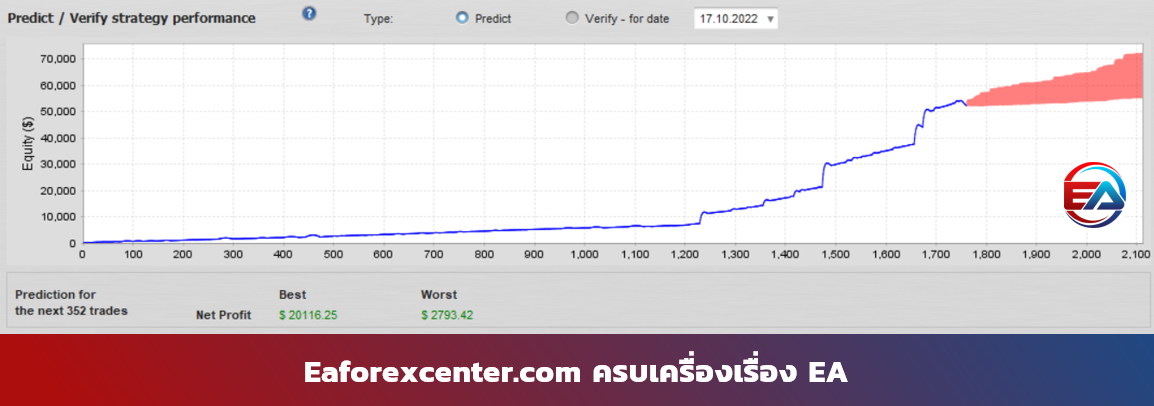

After analyzing the 5-year backtest results (GBP/USD pair) on myfxbook, Ichimoku EA achieved 384.51% profit with only about 40% drawdown, averaging 2.42% monthly profit. Monthly returns vary depending on forex market conditions.

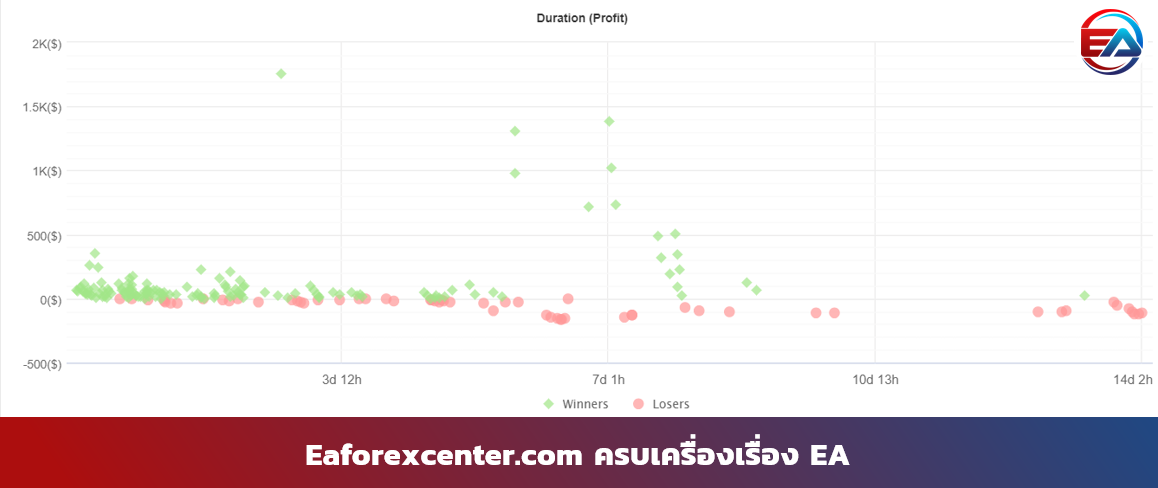

Looking at order holding times, this EA typically holds orders for 1-7 trading days, with a maximum of 14 days, making it a long-term trading system. It may not be suitable for those needing quick returns.

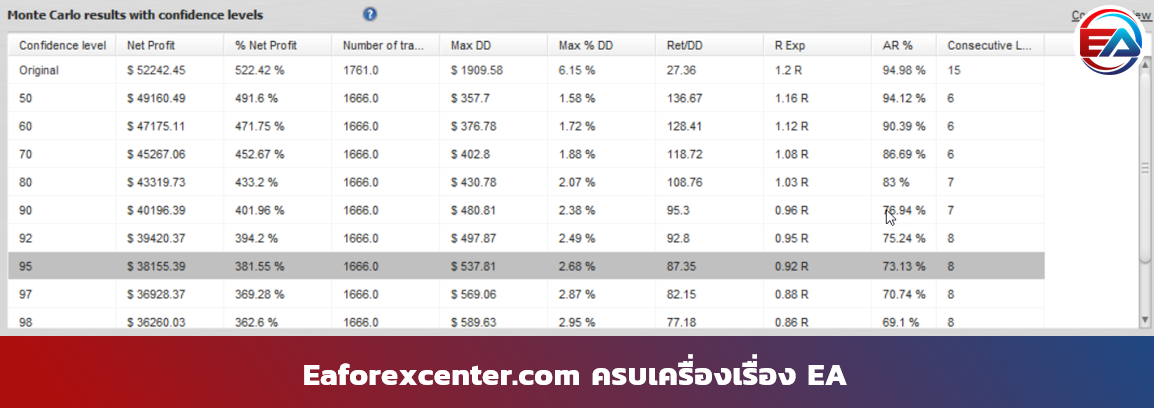

Testing real-world probability scenarios is crucial before using an EA. Analysis shows that at 95% CI, Max%DD is only 2.68% while maintaining profit near 381.55%, with a very high Return/DD ratio (87.35)

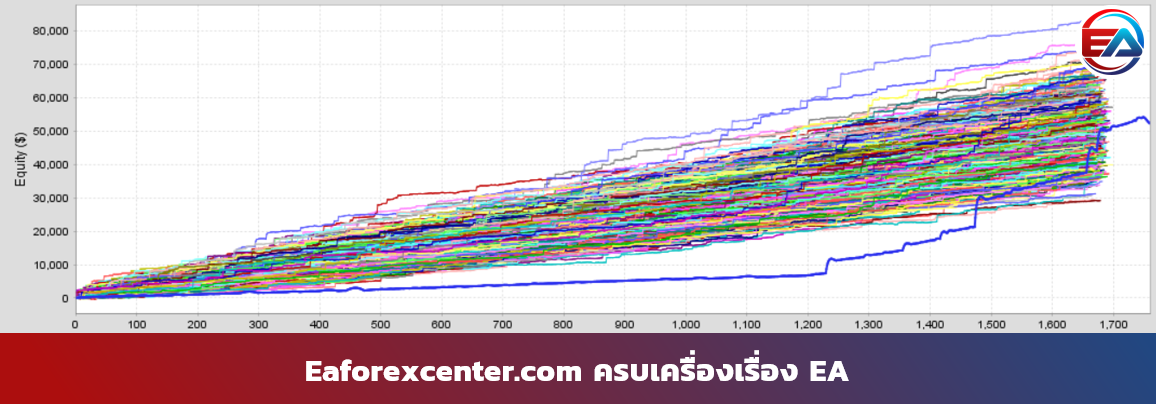

However, the Equity vs Orders graph shape isn’t perfectly ideal, as the original line slightly deviates from the simulated line, though it eventually converges at the graph’s midpoint.

Looking at the worst-case scenario, the EA continues to generate profits when left running, and in the best-case scenario, it can achieve significantly higher percentage gains.

- Ichimoku modification and setting

- Long term trading

- Auto lotsize

- Dynamic grid function

- Currency Pair: GBP/USD

- Time frame: H1

- Minimum capital: 10,000 USC or $1,000 for larger accounts

- Ping: 6-60 ms

- VPS: mt4could (recommended) as it allows selecting Server Location close to Broker to significantly reduce Ping or Latency

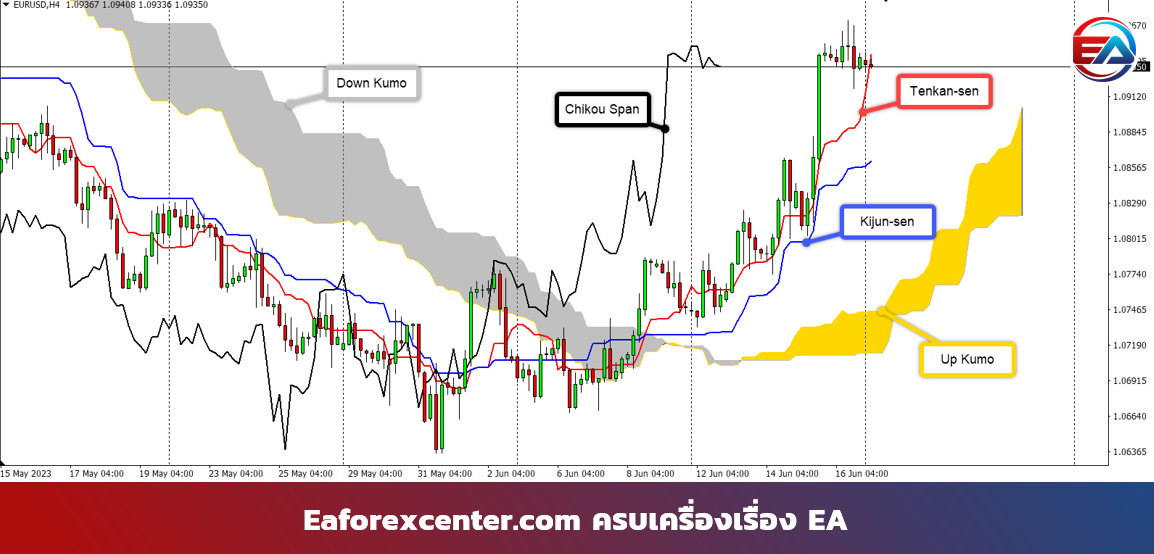

What is Ichimoku Kinko Hyo Indicator

Ichimoku, also known as Ichimoku Cloud, gets its name from its cloud-like appearance. Ichimoku Kinko Hyo is currently a highly popular indicator. Its versatility includes identifying support/resistance levels, market trends, and direct trading signals.

Ichimoku Cloud, commonly called just Ichimoku or Cloud system in Thailand, was developed by Goichi Hosoda in the 1930s. It took 30 years to perfect and was published in the 1960s. This comprehensive indicator works with all timeframes and markets, particularly popular in Forex.

How Ichimoku Kinko Hyo Indicator Works

Calculation Formulas and Meanings

Ichimoku Kinko Hyo consists of five lines, each with specific functions. Here are their names and calculation formulas:

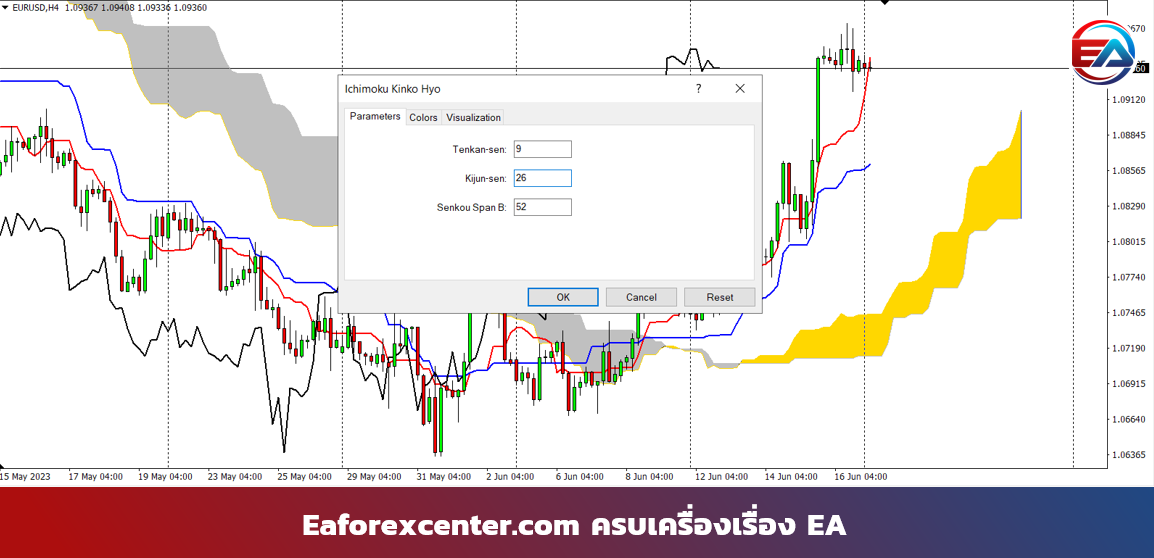

- Tenkan-sen: Short-term price movement line

Formula = (9-period high + 9-period low)/2))

Meaning: A flat line or lack of Higher High indicates short-term sideways movement

- Kijun-sen: Medium-term price movement line

Formula = (26-period high + 26-period low)/2))

Meaning: Kijun-sen provides trading signals similar to moving average crossovers, like using 2 EMA lines. It works in conjunction with Tenkan-sen

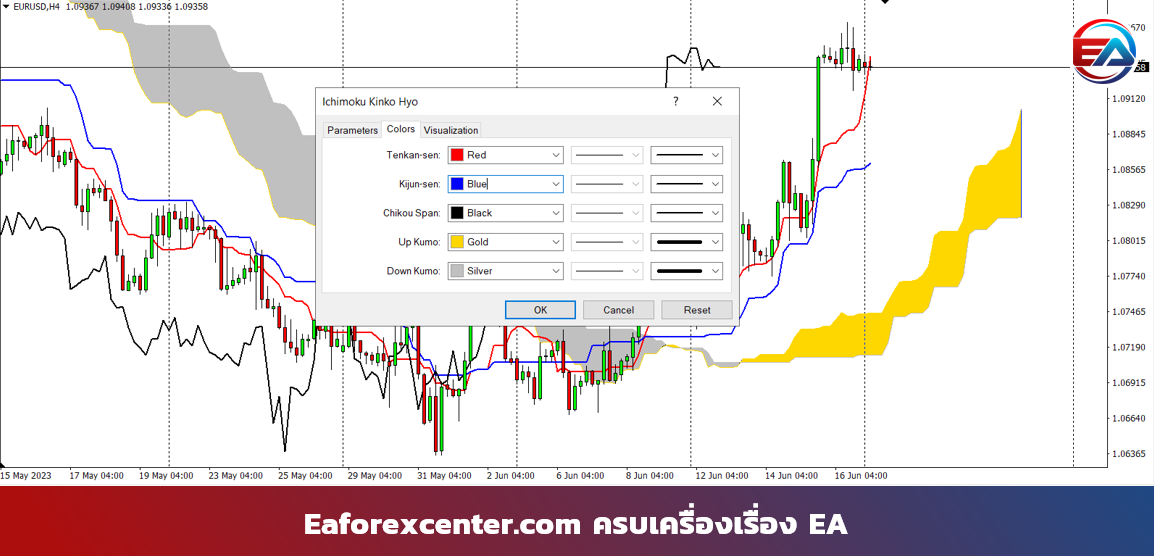

- Kumo or “Cloud”: Area between Senkou Span A and Senkou Span B

– Senkou Span A (Up Kumo)

Formula = (Conversion Line + Base Line)/2)), Plotted 26 days ahead

– Senkou Span B (Down Kumo)

Formula = (52-period high + 52-period low)/2)), Plotted 26 days ahead

Meaning: Price above the cloud indicates an uptrend, while price below the cloud indicates a downtrend

Another way to identify trends is by cloud color: yellow cloud (Senkou Span A > Senkou Span B) indicates uptrend, while gray cloud (Senkou Span A Senkou Span B) indicates downtrend

- Chikou Span: Overall short-term trading controller

Formula = Close plotted 26 days in the past, Plotted 26 days back

Acts as a filter or confirmation signal for Tenkan-sen and Kijun-sen crossovers. Chikou span above price confirms uptrend, below price confirms downtrend

How to Use Ichimoku Indicator

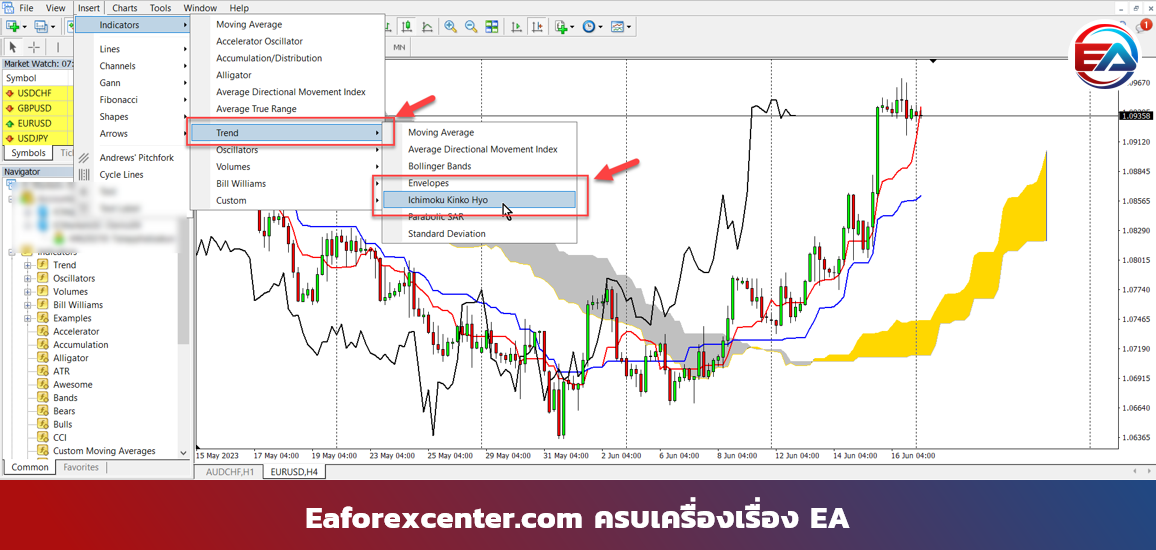

After understanding the formulas and background of Ichimoku, here’s a basic usage guide. Note that individual trading styles may vary. First, open MT4 and add the Ichimoku Kinko Hyo indicator as shown below:

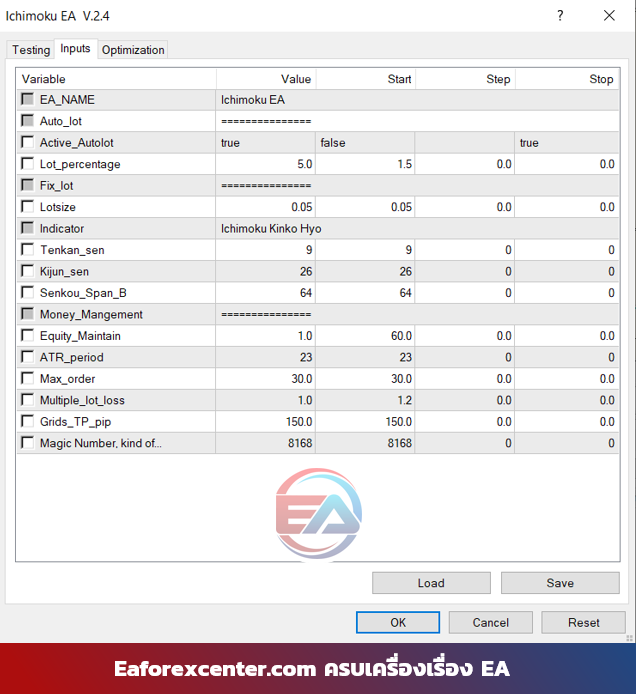

After adding the Ichimoku Kinko Hyo indicator, you’ll see this window. I personally use the default parameter settings as established by the developer:

After setting parameters, customize line colors and sizes for better visibility as shown below. You can adjust colors and sizes to your preference, then click “OK”:

After completing all settings, the Ichimoku Kinko Hyo indicator display will appear on your chart with components as shown below:

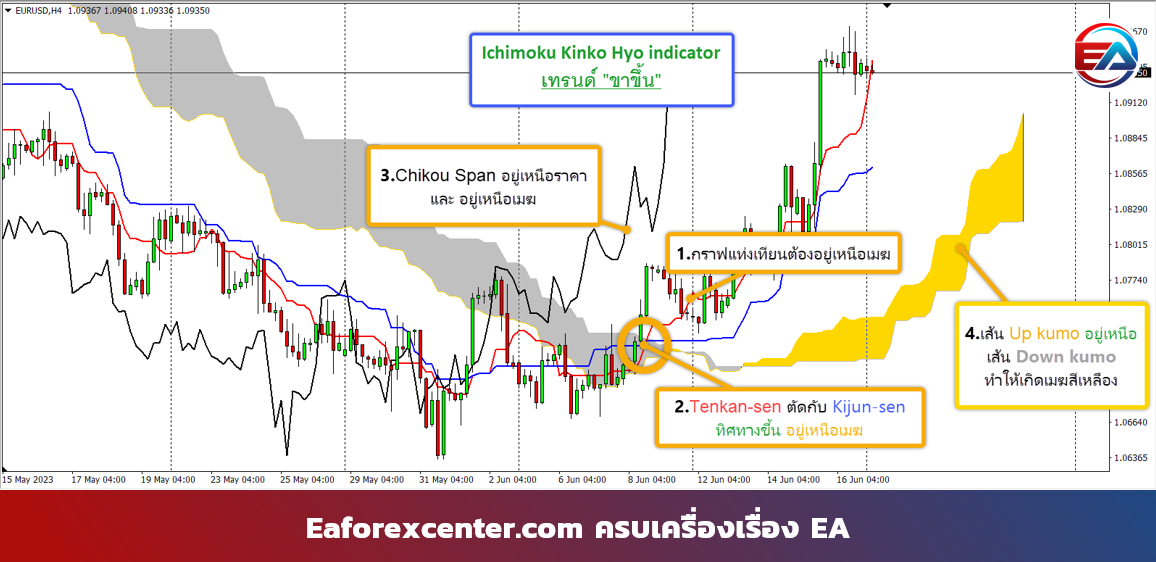

Now for usage methods. As mentioned, Ichimoku Kinko Hyo indicator is excellent for trend analysis and trading signals. I’ll explain two methods:

First Method: For uptrend analysis, follow conditions shown below. Enter Buy positions only when chart and lines meet all conditions. You can set Stop Loss below the cloud:

Second Method: For downtrend analysis, follow opposite conditions shown below. Enter Sell positions only when chart and lines meet all conditions. Set Stop Loss above the cloud. (If you prefer automated trading, you can use Ichimoku EA Forex)

“In war, you cannot expect to win every time; there will be both victories and defeats”

——–Quote from Romance of the Three Kingdoms by Cao Cao——–

Reviews

There are no reviews yet.