RSI

Relative Strength Index (RSI) is one of the most popular indicators. It’s easy to use, not complex, and falls under the Momentum Oscillator type of indicators. It indicates and shows momentum, price trends, and trading estimates.

Abstract

Relative Strength Index (RSI) is one of the most popular indicators. It’s easy to use, not complex, and falls under the Momentum Oscillator type of indicators. It indicates and shows momentum, price trends, and estimates trading. I encourage everyone reading to continue, because in this article we’ll explain how it came about, how it works, and how to profit from RSI.

History of Relative Strength Index (RSI)

Relative Strength Index (RSI): was created and developed by technical analyst J. Welles Wilder Jr. He explained this indicator in his book “New Concepts in Technical Trading Systems (1978)“. Additionally, ATR, Parabolic SAR were also created by Welles Wilder.

Basic usage and settings

Using and setting up RSI in Tradingview: Click Indicator on the top bar >> Type “RSI” >> Select “Relative Strength Index”, not RSI Strategy. Be careful to choose the right one.

For settings, you can use the default values, except for adjusting colors for easier viewing. But if you have your own formula, you can adjust the RSI Length or MA Type further.

Calculation formula for Relative Strength Index (RSI)

RSI calculation is an extension of Relative Strength (RS) but with an added index plot. The RSI calculation formula is divided into two somewhat complex parts, but we’ll simplify it for easier understanding as follows:

RSI = 100 – [100 / (1+RS)]

Where RS = Average gain over ‘N’ days divided by average loss over ‘N’ days (Usually N = 14)

When data and numbers are input into the formula, it’s plotted and displayed as a graph.

Basic interpretation

First, let’s break down the components of RSI. There are 2 main parts:

- Information bar

This section shows the values set for calculation and plotting the graph. This information includes the number of candles used for average calculation, MA type & MA Length, and the index or range that the RSI line runs from 0 – 100.

- Graph

The index or graph range is from 0 – 100, with lines drawn at 30 and 70 (default values). The next section will explain why the 30 and 70 ranges are important.

● Overbought signal

Overbought means there’s excessive buying. It’s shown on the RSI graph when it reaches 70 or higher. This occurs for a certain period. Imagine people rushing to buy a new shoe collection, causing prices to surge. Those who buy early can resell at a higher price.

● Oversold signal

Oversold means there’s excessive selling. It’s shown on the RSI graph when it reaches 30 or lower. This also occurs for a certain period. It corresponds to Overbought – when many people have the same shoe collection, selling at high prices becomes difficult, so they need to reduce prices or offer promotions to attract buyers.

Usually, the asset price graph and RSI graph move in the same direction. For example, if the price graph rises, RSI also rises. Conversely, if the price graph falls, RSI also falls. Overbought and Oversold occur alternately in this cycle almost continuously. However, sometimes the two graphs don’t move in the same direction.

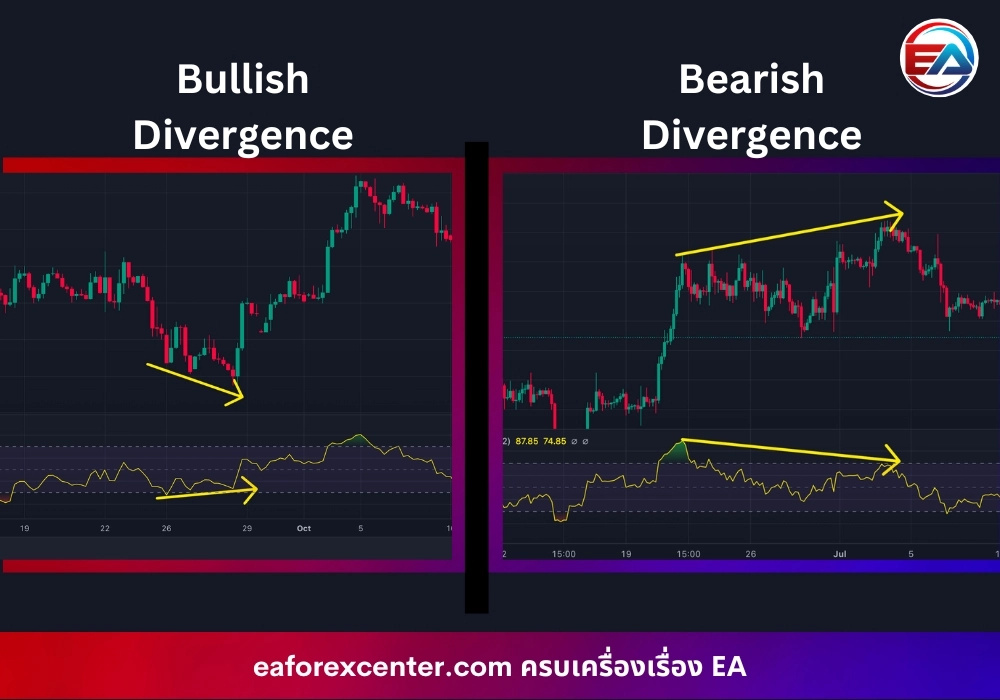

● Bullish Divergence signal

This occurs when the asset price graph and RSI graph have opposite trend directions, with RSI showing an uptrend (HL, HH) but price showing a downtrend (LH, LL). Bullish Divergence is a signal for a reversal to an uptrend.

● Bearish Divergence signal

Similar to Bullish Divergence but opposite. RSI shows a downtrend (LH, LL) but price shows an uptrend (HL, HH). It’s a signal for a reversal to a downtrend.

Trading system and entry-exit points

We can use all 4 signals explained above. The most basic approach is:

1. If Oversold signal appears, BUY

2. If Overbought signal appears, SELL

Easy, right? Yes, very easy. Too easy, in fact. You might make some profit with this system, but the market is much more complex. So when the market doesn’t follow the normal path, you need to use more complex signals like:

3. If Bullish Divergence occurs, BUY

4. If Bearish Divergence occurs, SELL

Bullish and Bearish Divergence signals are more complex than Oversold & Overbought because they require more time to become clear, and rely on the trader’s experience, understanding, and interpretation. Some may see it differently, or it might be a fake/false signal.

However, there’s no guarantee that when RSI touches 30 or 70, a reversal will occur. Prices may continue to fall or rise due to various factors. Therefore, you must consider factors affecting price and look at the overall market situation, as well as use other indicators to confirm the reversal.

Combining RSI with other indicators

Traders may choose to use RSI with other indicators to enhance market analysis and better understand price movements. It can be used in conjunction with:

- Bollinger Bands

When price touches the upper Bollinger Band and RSI is above 70, it’s an Overbought signal – you can Sell. Similarly, if price touches the lower Bollinger Band and RSI is below 30, it’s an Oversold signal – you can Buy.

- MACD

If RSI shows a Bullish Divergence and MACD crosses upwards, it can confirm with high accuracy that there’s a strong tendency for an upward reversal – you can Buy. For Sell, it’s the same but with opposite conditions to Buy.

It can be used with other indicators, but you need to study how both work to find connections and relevance.

Summary

RSI can predict price trends and reversals, but using RSI alone to determine trades isn’t enough to survive in the market. We should study comprehensively, use new trading patterns, combine with other indicators, do back testing, and always set Stop Loss for every trade. Give yourself plenty of time to practice, and may all traders create sustainable profits.

อ้างอิง

https://www.investopedia.com/terms/r/rsi.asp#toc-what-does-rsi-mean

https://capital.com/relative-strength-index

https://www.finnomena.com/mrserotonin/what-is-rsi/

Eaforexcenter Team

Reviews

There are no reviews yet.