RSI EA Forex

Features

- RSI modifying

- Martingale lot size

- RSI Period Setting

- TP and SL Setting

- Unlimited Account

Requirements

- Currency = EUR/USD and XAU/USD (for this one, please contact us privately)

- Time Frame = H1

- Capital = $1,000 OR 10,000 USC

What is RSI EA Forex

RSI EA Forex is an EA that incorporates the working principles of RSI, developed and adapted into a trading strategy… We’ve slightly modified its operation (read more about how it works below)

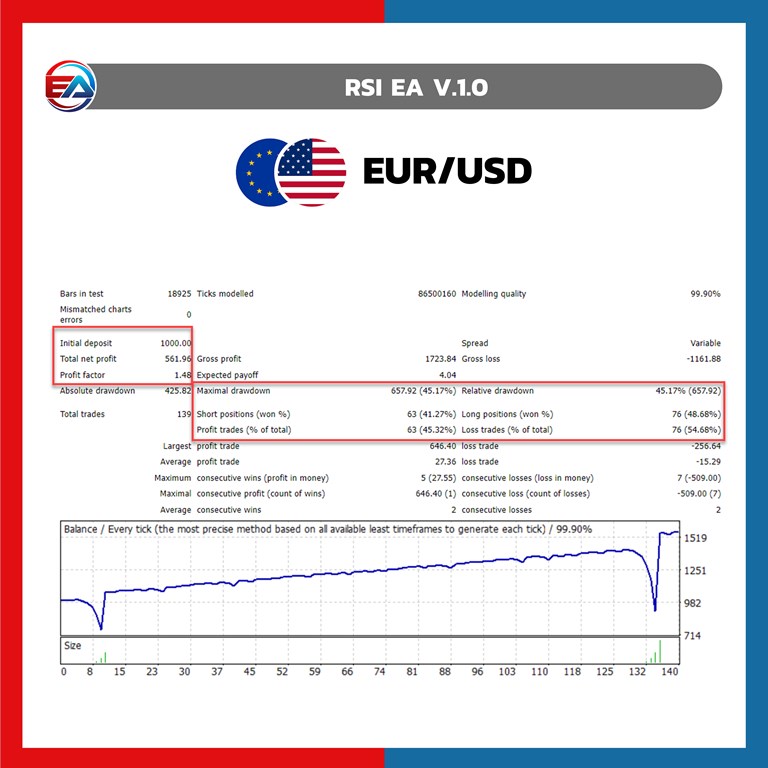

Backtest Results

|

Table of Backtest System Setup |

|||

|

Item |

Details | Item |

Details |

|

Data |

Tick data (99.90%) | Leverage |

1:500 |

|

Spread |

Variable | Optimize Slippage |

Use |

|

Market delay |

30-40 ms | Pending delay |

30-40 ms |

|

Maximum backtest period is 3 years |

|||

|

Interesting Parameters |

||

| Parameters | Variable value |

Interpretation |

|

Profit factor |

1.48 |

Low compared to %DD |

|

Profit/year |

18.00% |

Very low |

|

Max %DD |

45.17% |

Medium-high |

|

Relative %DD |

45.17% |

Medium-high |

This EA may not seem worthwhile for long-term unmonitored running. The reason for extended drawdowns is the occurrence of non-reversing Super Trends. We can reduce the risk of losses from such events by “stopping the EA during periods at risk of Super Trends, such as during wars or strong news announcements”

coming soon…

coming soon…

- RSI modifying

- Martingale lot size

- RSI Period Setting

- TP and SL Setting

- Currency = EUR/USD and XAU/USD (for this one, please contact us privately)

- Time Frame = H1

- Capital = $1,000 or 10,000 USC

- Broker = Compatible with all brokers

- Initial Lot size = 0.01

- SL = 40

- TP = 50

- RSI Period = 14

- RSI buy = 30

- RSI sell = 70

What is RSI Indicator

Relative Strength Index or RSI is one of the indicators used in trading analysis for a long time and remains popular to this day. It was developed in 1970 by J. Welles Wilder, a technical trading expert, using mathematical analysis before being written into a book called “New Concept in Technical Trading System”

The RSI Indicator has a value of 0 – 100 that indicates the strength of the Forex market and can also indicate the price of assets or even stocks, showing the current market condition

This indicator looks at momentum in a certain direction by calculating prices over a 2-week period, hence RSI 14 (2 weeks = 14 days) when viewed in the D1 timeframe

How RSI indicator works

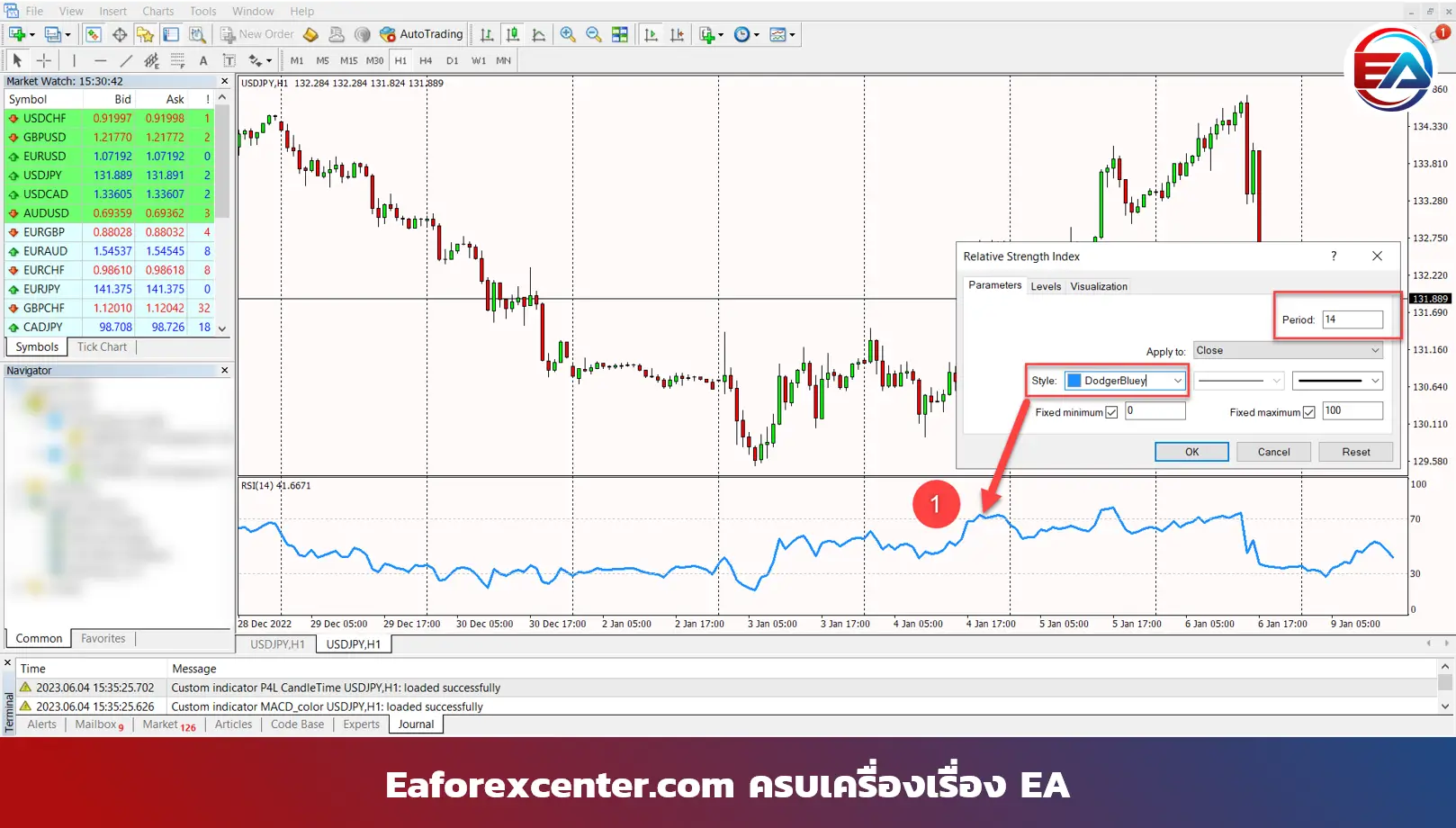

The working principle of RSI is not difficult. I’ll explain the RSI indicator window, which consists of 3 main parts, as numbered in the image below:

- The RSI line is the percentage change in price, ranging from 0 – 100, calculated from prices over a 14-candle period, hence RSI 14. This can be set to other values depending on individual techniques

- Level 30 line means price change percentage below 30, indicating “Oversold” condition. This can be set to other values

- Level 70 line means price change percentage above 70, indicating “Overbought” condition. This can also be set to other values

I’ll explain more about Oversold and Overbought so you can fully utilize this technique and apply it to other indicators. The principles of Oversold and Overbought are as follows:

Oversold

Oversold (OVS) is a condition where there’s excessive selling or when an asset has more selling pressure than usual, indicating that the product or currency pair has dropped too sharply

Observe the RSI line dropping below 30. This can result in a quick price rebound or further decline. It can be used in conjunction with other indicators like EMA or SMA for analysis and decision-making

Overbought

Overbought (OVB) is a condition where there’s excessive buying or when an asset has more buying pressure than usual, indicating that the product or currency pair has risen significantly

Observe the RSI line rising above 70. The price may quickly reverse or continue rising. It can be used with other indicators like EMA or SMA for analysis and decision-making

Conclusion

RSI EA Forex is an EA that we developed by applying the principles of the RSI indicator to create an EA Forex, making it easier for users to use without constantly watching charts, or to assist in trading when busy

However, traders should thoroughly study its operation before investing. Since all investments carry risks, only use cold money for trading

Change is not easy, but it’s always possible

– Barack Obama –

- coming soon…

Reviews

There are no reviews yet.